Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the value of size as a standalone factor.

Quote of the Day

"Backtests distort our perception of what’s truly long term."

(Adam Collins)

Chart of the Day

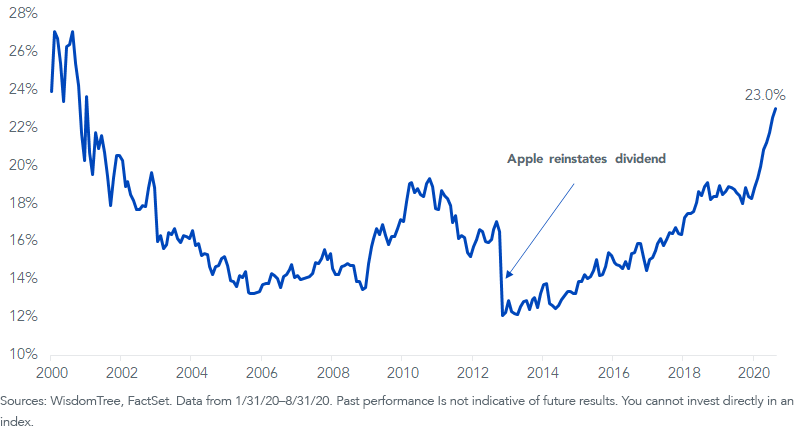

The percentage of the S&P 500 that doesn’t pay a dividend is on the rise.

Big reads

- "Upside-Down Markets: Profits, Inflation and Equity Valuation in Fiscal Policy Regimes" by Jesse Livermore (osam.com)

- "Liquidity Cascades: The Coordinated Risk of Uncoordinated Market Participants" by Corey Hoffstein (blog.thinknewfound.com)

- What these two papers tell us about how the world has changed. (awealthofcommonsense.com)

Asset allocation

- Different investors have successfully argued for very different asset allocation models. How to choose between them? (breakingthemarket.com)

- "The frequency of turning points has a significant impact on the performance of a simple trend-following strategy." (allocatesmartly.com)

Country selection

- Can you use the CAPE ratio to choose among global stock markets? (alphaarchitect.com)

- Knowing the growth rates of various countries doesn't tell you much about their equity returns. (seekingalpha.com)

Research

- It is still hard to find evidence of stock picking skill among active managers. (alphaarchitect.com)

- An assessment of cash-return-on-invested-capital (CROIC) as an alternative value metric. (factorresearch.com)

- How to include earnings revisions in a quant model. (blog.validea.com)

- Why you should expect to see the continued blurring of public and private markets. (medium.com)

- News flash: hedge fund managers like to talk to each other. (institutionalinvestor.com)

- For a long time, Value Line WAS investment research. (marketwatch.com)