Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why most investment strategies leave taxes out of the equation.

Quote of the Day

"While sales growth may be the largest component of stock returns, it is uncertain and comes with high multiples that are also uncertain and have more room to fall."

(Greg Obenshain)

Chart of the Day

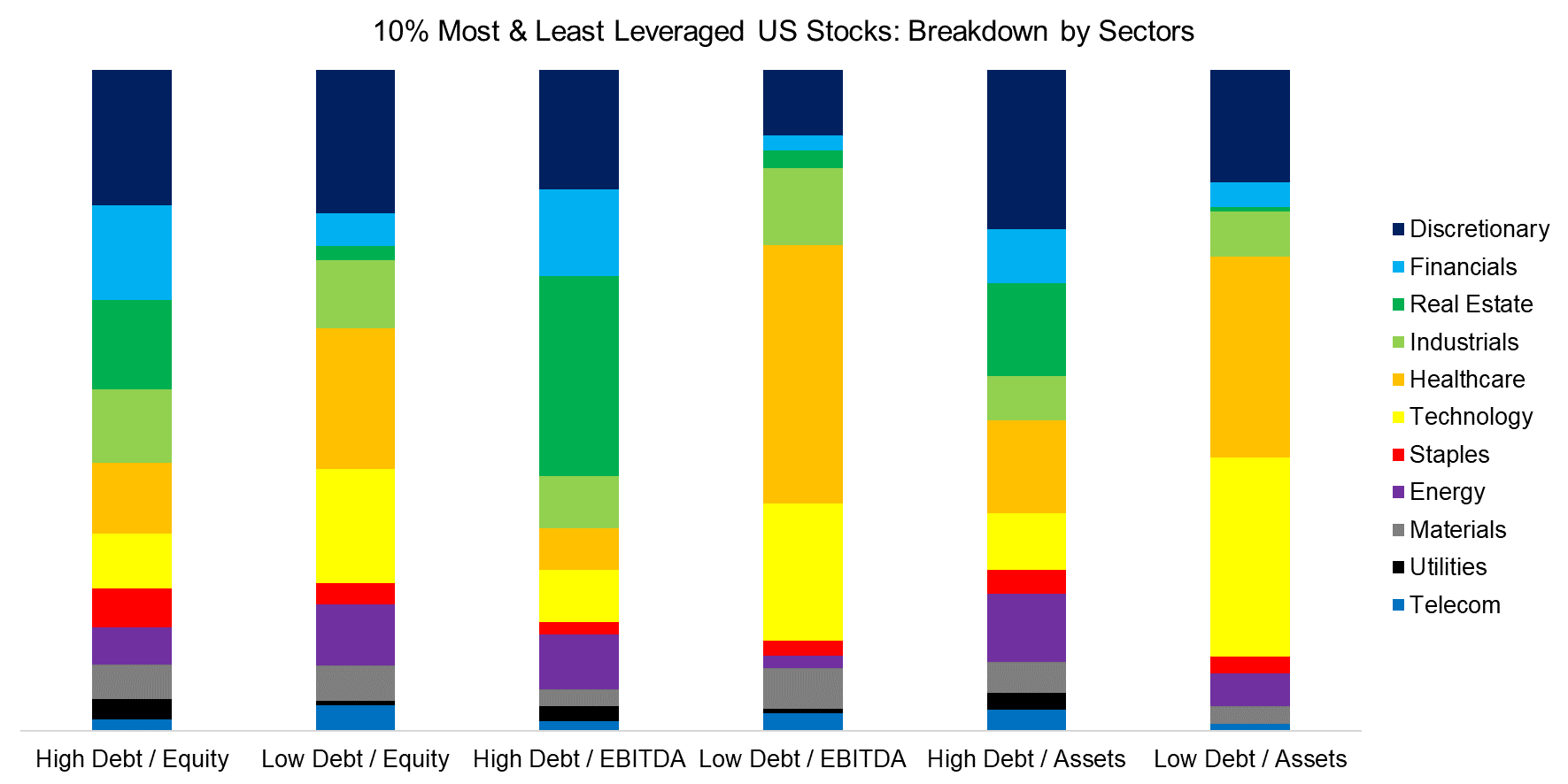

Technology and health care are the two least leveraged sectors in the US.

Alternatives

- A long-term look at how elite university endowments have managed their money. (tandfonline.com)

- This paper is skeptical that you can replicate private equity returns with publicly traded securities. (institutionalinvestor.com)

- Venture capital returns show mean reversion and the important of starting off with a big winner. (evidenceinvestor.com)

Research

- Current accounting standards do a poor job of accounting for intangible assets - from a new Michael Mauboussin white paper. (morganstanley.com)

- Options strategy index returns depend heavily on construction. (osm.netlify.app)

- Should you be able to make money using simple timing methods? (priceactionlab.com)

- On the whole, Robinhood traders, are not thrill seekers. (nber.org)

- A new sentiment index, the Addepar Investor Sentiment Index has launched tracking HNWI. (riaintel.com)