Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at how Sharpe ratios are used and abused in the real world.

Quote of the Day

"Many investors and market observers still unfortunately conflate value investing with the value factor. Value investing is buying something for less than it is worth. The value factor is an ersatz measure of gaps between price and value. Worse, the relevance of the value factor is fading."

(Michael Mauboussin)

Chart of the Day

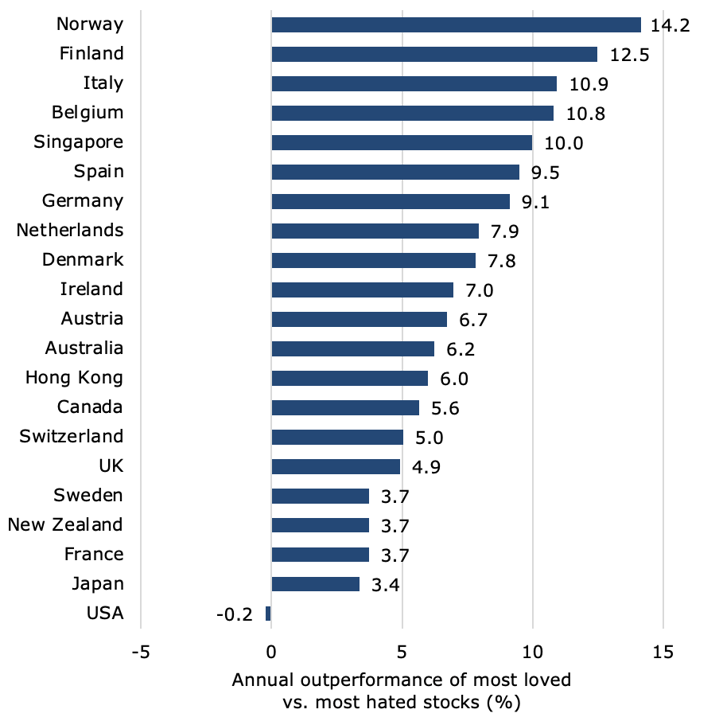

The U.S. is an outlier when it comes to the value of analyst recommendations.

Quant stuff

- Economic forecasts are largely useless for the purpose of investing. (mrzepczynski.blogspot.com)

- Does persistence persist in PE and VC? No and yes. (privpapers.ssrn.com)

- Big banks lend to big firms. Small banks to small firms. (sciencedirect.com)

- How to use NBA statistics to spot higher performing startups. (a16z.com)

Factors

- "We estimate that Morningstar rating chasing explains a substantial part of the size and value factors' time-series variation." (privpapers.ssrn.com)

- Factors don't work in currency markets any more. (klementoninvesting.substack.com)

- Questions to ask before buying any multifactor fund. (morningstar.com)

Research round-ups

- The rebalancing premium is real, but it frequency-dependent. (breakingthemarket.com)

- Is this a simple fix for the CAPE ratio? (alphaarchitect.com)

- There doesn't seem to be much difference in the returns of systematic vs. discretionary equity neutral hedge funds. (factorresearch.com)

- Breadth indicators, by construction, compress information. (priceactionlab.com)

- How value investing lost its way. (appliedfinance.com)