You can do everything right when it comes to the pandemic and still get infected.

You can do everything right in your financial life and still experience money stress.

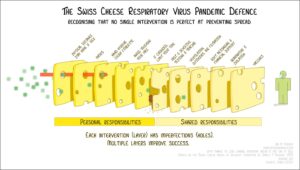

That’s the nature of life – it is unpredictable and answers to no one. The best we can do is stack layers of (imperfect) defenses one upon another. A few weeks ago in my weekly newsletter for advisers I highlighted something called the ‘Swiss Cheese Covid-19 Defense’ which I initially saw on kottke.org.

“The Swiss cheese model of accident causation is a framework for thinking about how to layer security measures to minimize risk and prevent failure. The idea is that when several layers of interventions, despite their weaknesses, are properly stacked up between a hazard and a potentially bad outcome, they are able to cumulatively prevent that outcome because there’s no single point of failure.”

Like the Swiss cheese model above, financial planning is about minimizing risk and avoiding failure. This means being able to meet our goals, fulfill our obligations, in short, to be okay. By avoiding single points of failure and stacking multiple layers of protection we can reach a point where we can have greater confidence in the future. The world is going to keep changing but this approach can help us better adapt to the times.

Siobhan Roberts in the New York Times recently spoke with Ian M. Mackay, a virologist at the University of Queensland, who designed the above graphic about what it means for combating the pandemic. The whole thing is worth a read. Here is an excerpt:

Q. What does the Swiss cheese model show?

A. The real power of this infographic — and James Reason’s approach to account for human fallibility — is that it’s not really about any single layer of protection or the order of them, but about the additive success of using multiple layers, or cheese slices. Each slice has holes or failings, and those holes can change in number and size and location, depending on how we behave in response to each intervention.

A lot of people are not okay in the pandemic. Even a cursory glance a the graphic shows where we are falling down. The point of highlighting the Swiss cheese model isn’t to highlight a pandemic which needs no further hype. Admittedly it is more about showing that doing what we can, when we can, is a useful model for many of the issues we face in our lives.

One of my favorite things to do as a blogger is to highlight concepts that originate outside the financial world. This is more impactful than reiterating post-expiration, financial cliches. So if you are interested in more insights like this specifically for financial advisers please sign up for our weekly newsletter which brings you this type of content every week.