Are you already signed up for our daily e-mail newsletter? That’s awesome, but did you also know that we publish an adviser-focused e-mail every Friday? Now you do.

Quote of the Day

"Building an identity around a sector or a company can be incredibly dangerous to not only your financial health, but your psyche as well."

(Aaron Edelheit)

Chart of the Day

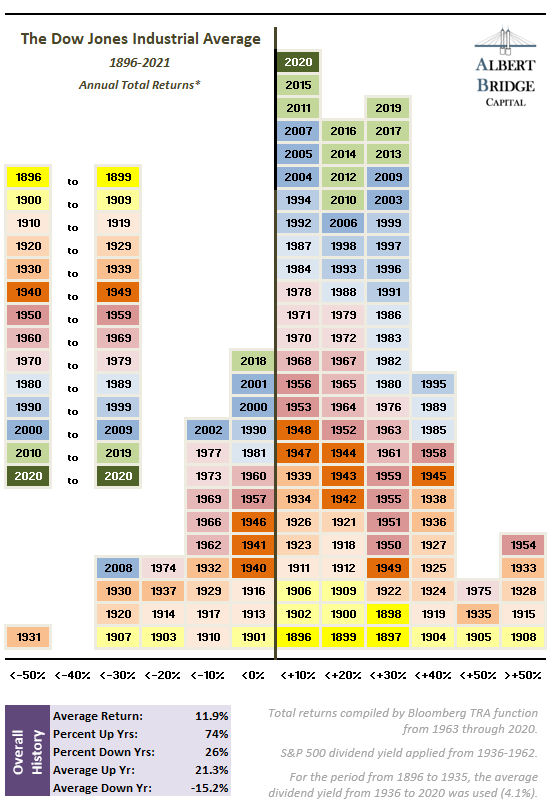

Putting the Dow’s 2020 performance into some perspective. (chart via @albertbridgecap)

Markets

- How every asset class performed in 2020. (visualcapitalist.com)

- Seven tech companies added $3.4 trillion in value in 2020. (cnbc.com)

- Consumer discretionary stocks continue to outperform staples. (allstarcharts.com)

- Market timers are wicked bullish. (marketwatch.com)

Lessons

- Lessons learned from George Vanderheiden including 'Manias often end at the end of a calendar year.' (gavin-baker.medium.com)

- 20 rules for investing - the 2020 edition including 'Price targets are pointless. Forecasts are foolish.' (compoundadvisors.com)

- Some lessons learned from Jack Schwager's newest book "Unknown Market Wizards." (stockcharts.com)

Strategy

- Fred Wilson, "Here is the thing about speculative frenzies – they are generally directionally correct but off in their order of magnitude. And they finance the trend that they are directionally correct about." (avc.com)

- Why you should wean yourself off the news in 2021. (allstarcharts.com)

- A message to everyone who started trading stocks in 2020. (crossingwallstreet.com)

- This is the only forecast you need for the new year. (ritholtz.com)

Crypto

- Bitcoin topped 30,000 in the new year. (bloomberg.com)

- Hedge funds focused on crypto had a good 2020. (fnlondon.com)

- What is that status of all those ICOs from 2017? (ft.com)

- The dream of a Bitcoin ETF isn't dead. (msn.com)

SPACs

- Here's one way SPACs have a big leg up on traditional IPOs. (wsj.com)

- The big year for SPACs by the numbers. (visualcapitalist.com)

ETFs

- A review of the year in ETFs including the best launches. (etftrends.com)

- Expect more ESG and thematic ETFs in 2021. (barrons.com)

Global

- The NYSE is delisting three Chinese companies due to an executive order. (axios.com)

- India has approved two Covid vaccines ahead a big vaccination push. (washingtonpost.com)

- Brexit is now a reality. What you need to know. (axios.com)

Policy

- A $15 minimum wage keeps gaining ground around the country. (nytimes.com)

- How the pandemic WFH experiment exposed some of the crack's in California's business foundation. (project-syndicate.org)

- Will the Biden administration be any better at building infrastructure? (economist.com)

- Just because someone has been released from prison doesn't mean they are free of a range of “collateral consequences.” (politico.com)

- A notable portion of Americans believe in various baseless conspiracy theories. (npr.org)

Economy

- The improving trend in jobless claims has reversed going into 2021. (bonddad.blogspot.com)

- The economy was characterized by a big shift from services to goods. (nytimes.com)

- The economic schedule for the coming week. (calculatedriskblog.com)

Earlier on Abnormal Returns

- The most-read items this week on the site. (abnormalreturns.com)

- What you missed in our Saturday linkfest. (abnormalreturns.com)

- Coronavirus links: a year of anguish. (abnormalreturns.com)

- How we will view 2020 depends on what happens next. (abnormalreturns.com)

- Collectibles investing looks like but fun, but you need to recognize the overriding role that taste and psychology play in pricing. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter just for advisers. (newsletter.abnormalreturns.com)