Are you already signed up for our daily e-mail newsletter? That’s awesome, but did you also know that we publish an adviser-focused e-mail every Friday? Now you do.

Quote of the Day

"The super interesting thing about 2020 is that it was basically an entire market cycle inside of a larger market cycle."

(Cullen Roche)

Chart of the Day

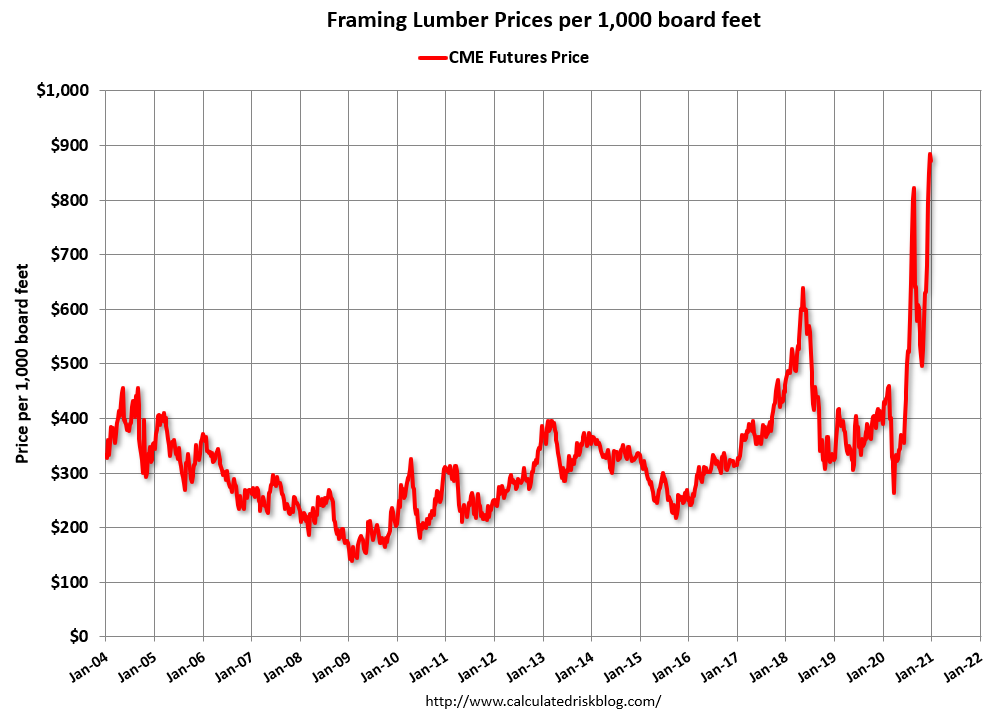

Lumber prices are showing no sign of coming back down to earth.

Markets

- The speed and breadth of market moves in 2020 was breathtaking. (awealthofcommonsense.com)

- How major asset classes performed in December 2020. (capitalspectator.com)

- The best and worst performing sectors of 2020. (visualcapitalist.com)

- A look back at the 'Factor Olympics' in 2020. (factorresearch.com)

- 2020: the year in charts including a look at 'IPO fever.' (compoundadvisors.com)

Strategy

- Sometimes models stop working. (crossingwallstreet.com)

- It never pays to give casual advice about investments. (theirrelevantinvestor.com)

- 5 investing insights from Charlie Munger including the importance of 'knowing your circle of competence.' (behavioralvalueinvestor.com)

Crypto

- The Bitcoin story is increasingly institutional. (axios.com)

- Bitcoin is nothing if not volatile. (bloomberg.com)

- Why Bitcoin isn't going to zero. (ofdollarsanddata.com)

Collectibles

- Pablo Torre talks with Dan Hajducky about how sports cards went from hobby to 'asset class.' (podcasts.apple.com)

- A CNBC segment on the booming sports card business. (twitter.com)

Companies

- Why is Bill.com ($BILL) getting lumped in other, better companies? (notboring.substack.com)

- The much-hyped Haven health care venture is closing up shop. (nytimes.com)

Finance

- Blackrock ($BLK) is struggling in its attempt to break into the private equity business. (wsj.com)

- The SPAC pipeline is still full. (axios.com)

Funds

- Where would bond funds have been if the Fed hadn't intervened in March? (finance.yahoo.com)

- Investors are the ultimate arbiters of fund fees. (morningstar.com)

Global

- The U.K. is going back on lockdown. (fortune.com)

- Israel is leading the way on getting shots in arms. (ft.com)

- How Taiwan plans to stay largely coronavirus-free. (nytimes.com)

Miami

- How Miami became a destination for tech-types. (news.crunchbase.com)

- Virtu Financial ($VIRT) is moving some workers to Miami. (bloomberg.com)

- Blackstone ($BLK) is opening an office in Miami. (therealdeal.com)

Economy

- The real yield on the 10-year Treasury fell to its lowest level in history. (axios.com)

- The Fed is on hold and will rely on fiscal stimulus to boost the economy. (blogs.uoregon.edu)

- There are some big holes in the arguments of 'Inflation truthers.' (awealthofcommonsense.com)

- The economy is much bigger than what you personally experience. (ritholtz.com)

Earlier on Abnormal Returns

- Research links: extrapolating fundamentals. (abnormalreturns.com)

- Adviser links: a critical skill. (abnormalreturns.com)

- January ESG links: forecast uncertainty. (abnormalreturns.com)

- How we will view 2020 depends on what happens next. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter just for advisers. (newsletter.abnormalreturns.com)