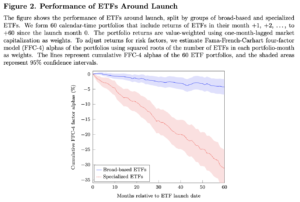

The following chart has been floating around and tells a simple and compelling story: specialized ETFs have a tendency to underperform after their launch.

Source: Competition for Attention in the ETF Space by Ben-David, Franzoni, Kim and Moussawi

Nobody launches specialized or thematic funds at market bottoms. They do so close to (relative) market tops. You don’t see anybody today gearing up to launch a coal ETF. From the abstract the chart above is taken from.

“Specialized ETFs hold stocks with salient characteristics–high past performance, media exposure, and sentiment–that are appealing to retail and sentiment-driven investors. After their launch, these products perform poorly as the hype around them vanishes, delivering negative risk-adjusted returns. Overall, financial innovation in the ETF space follows two paths: broad-based products that cater to cost-conscious investors and expensive specialized ETFs that compete for the attention of unsophisticated investors.”

No matter what academics or anybody else writes there is always going to be a temptation jump into the hottest stock, sector or fund manager. It’s the nature of the beast. We can’t help ourselves. As Ben Carlson at A Wealth of Common Sense writes:

“Investors don’t have a great track record when it comes to chasing the hottest fund of the day.”

Just this week it was reported that the Templeton Global Fund, run by Michael Hastenstab, a once $70 billion fund has seen some 80% of its assets leave. In this market, Cathie Wood of Ark Invest, has become the latest star manager. Her firm’s every move sparks attention, especially when planning to launch a new sector fund.

As Jason Zweig at the WSJ points out, it takes time to get a thematic fund up and running. It takes even longer for three ETFs to come to market in the case of SPACs. Zweig writes:

“Well, I’ve got a tip for you. If you think you’ve spotted a theme that other investors haven’t fully appreciated yet, ask yourself how come there’s already a thematic fund for it.”

If you still can’t help yourself from taking a flier on a specialized fund. The key is to limit the potential damage. As The Accumulator at Monevator writes:

Just like you wouldn’t bet your house on the outcome of the Grand National, keep your stock market bets survivable.

Overweight 10% of your equity allocation, tops.

Enough to enjoy your win should you back the right horse. But not so much that the pain will unbearable if you invest in the next air industry or Argentina.

Will every new thematic fund turn into the next Argentina? Of course not. But you need to consider the base rate. Picking a thematic fund right out of the gate is a tough proposition. For most investors the winning move is to not play the game at all.