I used to concern myself more with discussions about market valuations. Over time I have found these arguments increasingly tedious or specious. The point isn’t that valuations don’t matter. They do. The point is that we know a lot less about valuations than we think we do.

It’s easy to put up charts and graphs about the state of market valuations. These presentations are, to the degree to which the data are complete and accurate, strictly true. That’s not the issue. The issue is that markets change. The S&P 500 today is not the S&P 500 from 5 years ago, let alone 50 years ago. A few weeks ago I wrote:

Like everything else in this world, markets evolve over time, sometimes dramatically. Human behavior (largely) hasn’t. But don’t let that lull you into thinking that an index that once was filled with sugar, tobacco and coal companies tells us much about what is happening in an Internet-enabled economy.

Mini-screed, out of the way, I did find a few recent items on the question of valuations worth mentioning. The first comes from noted venture capitalist Fred Wilson at his blog A VC where he writes:

When economies recover and interest rates rise, the air will come out of the asset price bubbles that have built up and the go go markets will hit the brakes.

When will that happen? Your guess is as good as mine. It could be later this year. It could be in a few years. It could take longer. A lot of damage has been done to the global economy and it is unclear how quickly it can recover.

Ben Carlson at A Wealth of Common Sense looks at some of the reasons why investors are so bullish right now including an expanding vaccine rollout and and a red hot housing market. Because of these tailwinds, and more. investors are willing to overlook some valuation excesses. Like Wilson, the question is when does all this end? Carlson writes:

Never say never in the markets, but your baseline assumption right now almost has to be that valuations won’t matter for a while or investors will simply continue to ignore them.

Yes, fundamentals will always matter eventually when it comes to the markets but the next 18-24 months is setting up to be one of the better economic environments we’ve seen in some time.

Both of the above are focused on the macro picture, but there is something else going on below the surface at the company level.

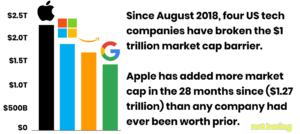

Source: Not Boring

Packy McCormick writing at Not Boring looks at why so many companies, both public and private, are seeing their valuation re-rated higher. His thesis is that the dominance of the FAAMG stocks has raised the theoretical cap on what a company could aspire to. There are now four companies with market caps no well in excess of $1 trillion. McCormick writes:

The market caps of the FAAMG companies are the most important numbers in the market, because consciously or not, investors are pegging their private and public tech company investments against them.

Instead of Price/Sales or Price/Earnings, high-potential tech companies are subconsciously being valued on Price / FAAMG, or a probability that those companies will become as big as today’s biggest, and it’s not crazy.

You can argue that pegging a startup’s valuation to some multiple of Apple or Amazon doesn’t make a ton of sense, but that seems to be what investors are doing. Looking at even bigger outcomes in the right side of the distribution makes for bigger valuations today.

Nobody knows how this all plays out. It could take years, months or days to resolve itself. The main point is that markets are dynamic. Things change, especially valuations. If they didn’t, then following the markets would be boring.