It’s possible, but who cares? Let me explain.

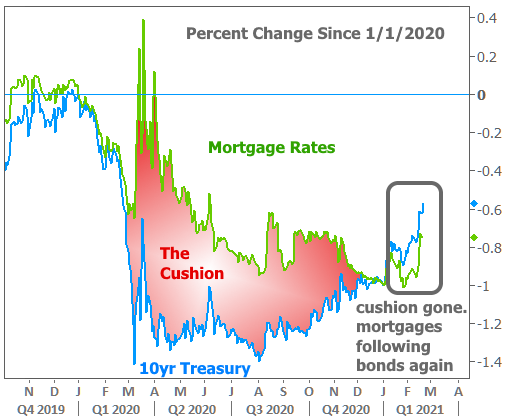

Exactly six weeks ago I wrote about why it was time to seriously think about refinancing your mortgage if you hadn’t done so already. At the time 30-year mortgages were averaging 2.65%. According to this report they are in excess of 3.0%. Matthew Graham at Mortgage Daily News notes why mortgage rates are now trending higher along with Treasury yields. The unusual spread that existed for most of last year is now gone.

Source: Mortgage Daily News

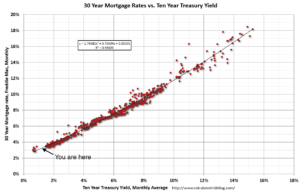

The point being that if Treasury yields continue moving up you should expect to see mortgage rates follow along. So is this some sort of disaster? No. Mortgage rates are back to where for most of 2020, but they are well off the lows see at the beginning of the year which we noted at the time. However, in the broad scheme of history, mortgages are still pretty darn low.

I noted on this chart from Bill McBride at Calculated Risk where things currently stand. You have to squint to see the difference between today’s rates and the all-time lows of a couple months ago.

Source: Calculated Risk (author annotation)

You were never going to bottom tick the lows in mortgage rates. If you did it would have been through luck and the timing of the back office of your mortgage provider. By all accounts 2021 and 2022 are going to be a crazy time for the U.S. economy. Might as well scratch a mortgage refinancing, off your to-do list. The hope being you have other (fun) stuff you will want to do later this year.