Quote of the Day

“We’ve never seen pricing like this ever in the convertible market.”

(Michael Voris, head of convertible bond financing at Goldman Sachs)

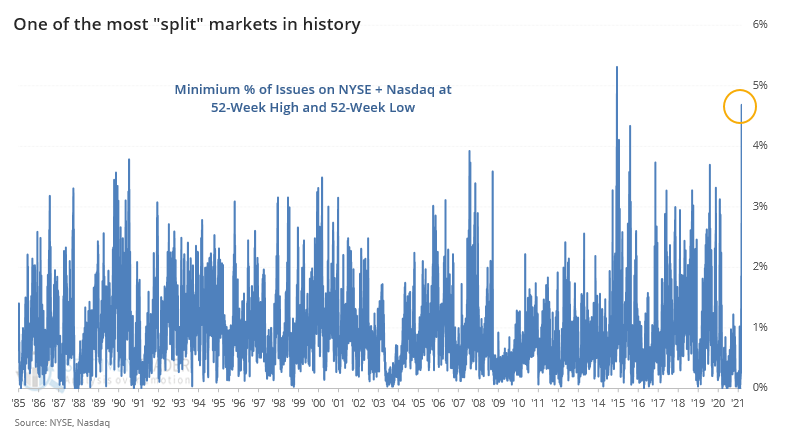

Chart of the Day

A large number of U.S. stocks are making 52 week highs AND 52 week lows. (via @sentimentrader)

Markets

- Four parallels between today's market and the late-1990s. (morningstar.com)

- Rising bond yields have pushed 30-year mortgage rates above 3%. (wsj.com)

- The EV space is in retreat. (ft.com)

Strategy

- Only once in the past decade has a correction turned into a full-blown rout. (theirrelevantinvestor.com)

- There are plenty of culprits for the recent sell-off (ritholtz.com)

- Why are people so freaked out? (ofdollarsanddata.com)

Hype machines

- The collectibles market is going to expand to fill all the demand out there. (thereformedbroker.com)

- Leonid Bershidsky, "The crypto world produces, lives, breathes, monetizes hype." (bloomberg.com)

- Why 'merch drops' have taken over brands. (marker.medium.com)

ETFs

- The VanEck Vectors Social Sentiment ETF ($BUZZ) got off to a fast start, volume-wise. (finance.yahoo.com)

- David Nadig talks liquidity with ARK Invest COO Tom Staudt. (etftrends.com)

Economy

- The U.S. economy added 379,000 jobs in February. (calculatedriskblog.com)

- Today's NFP numbers don't tell us much about the future. (nytimes.com)

Earlier on Abnormal Returns

- Podcast links: talking SPAC. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: a natural calamity. (abnormalreturns.com)

- March ESG links: sustainable momentum. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)