Quote of the Day

"Whatever the case may be, it appears Dalio doesn’t allow his macro predictions to influence Bridgewater’s investment strategy. Or if he does, it certainly doesn’t show up in their long-term track record."

(Ben Carlson)

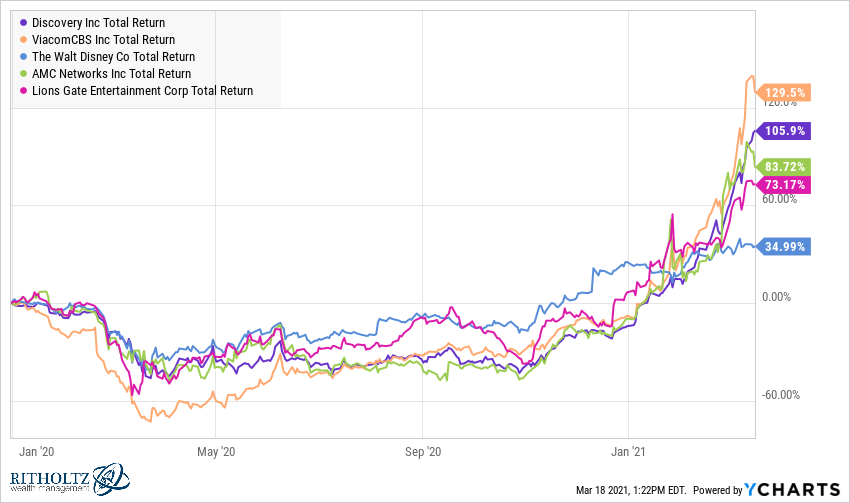

Chart of the Day

Legacy media companies have had a good run of late. (chart via @ycharts)

Markets

- Penny stock trading is booming. So are penny stock scams. (nytimes.com)

- What it's like to sell your Tesla ($TSLA) shares way too early. (monevator.com)

Crypto

- BNY Mellon ($BK) is investing in crypto startup Fireblocks. (wsj.com)

- Morgan Stanley ($MS) has cracked the door option to Bitcoin for clients. (cnbc.com)

- How to think about Bitcoin as an investment. (retirementfieldguide.com)

- Why it's past time for a Bitcoin ETF. (wisdomtree.com)

Apple

- Why Intel's ($INTC) new ad starring Justin Long just doesn't work. (daringfireball.net)

- New iPads are coming as soon as next month. (sixcolors.com)

ETFs

- Vanguard is joining the actively managed ultra-short bond ETF game. (riabiz.com)

- Are SPAC ETFs the best way to access the space? (etf.com)

Global

- The global supply chain mess is pretty universal. (wsj.com)

- Some reforms are coming for Australia's big supperannuation system. (evidenceinvestor.com)

Economy

- Weekly initial unemployment claims came in higher than expected. (bonddad.blogspot.com)

- Nobody really knows how inflation is going to play out this cycle. (realreturns.blog)

Housing

- Some signs that demand for second homes remains strong. (nytimes.com)

- Don't hold your breath for 2% 30-year mortgage rates any time soon. (housingwire.com)

Earlier on Abnormal Returns

- Longform links: the road salt oligopoly. (abnormalreturns.com)

- What you missed in our Wednesday linkfest. (abnormalreturns.com)

- Personal finance links: dumb luck. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)