There were this any number of posts looking at the past pandemic year including the stunning comeback in the capital markets. Not only a comeback but a full-on feeding frenzy for all manner of assets, both mainstream and speculative.

This just goes to show you than human behavior is unpredictable. More important the markets it will be fascinating to see if human behavior changes in any noticeable way, post-pandemic. For example, some have argued that we could be facing a new ‘Roaring 20’s‘ where a head brew of relief and growth kick of all manner of new behaviors.

One thing that the pandemic should reinforce for all of us is that our time here is limited and the end may come before we are ready for it. Prior to the pandemic the majority of Americans were happy not to spend down the assets they saved in retirement.

Peter Coy writing at Bloomberg about the results of an EBRI study concludes: “It’s undeniable, though, that a lot of Americans are underspending in retirement.” One reason why this might be the case is that priorities change in retirement. The EBRI study states:

“Priorities change during retirement: Maintaining health and wellness in retirement was by far the most important goal at the time people retired: 81 percent said it was very or extremely important. This became more important as retirement progressed. In contrast, traveling became less important for a quarter of survey respondents.”

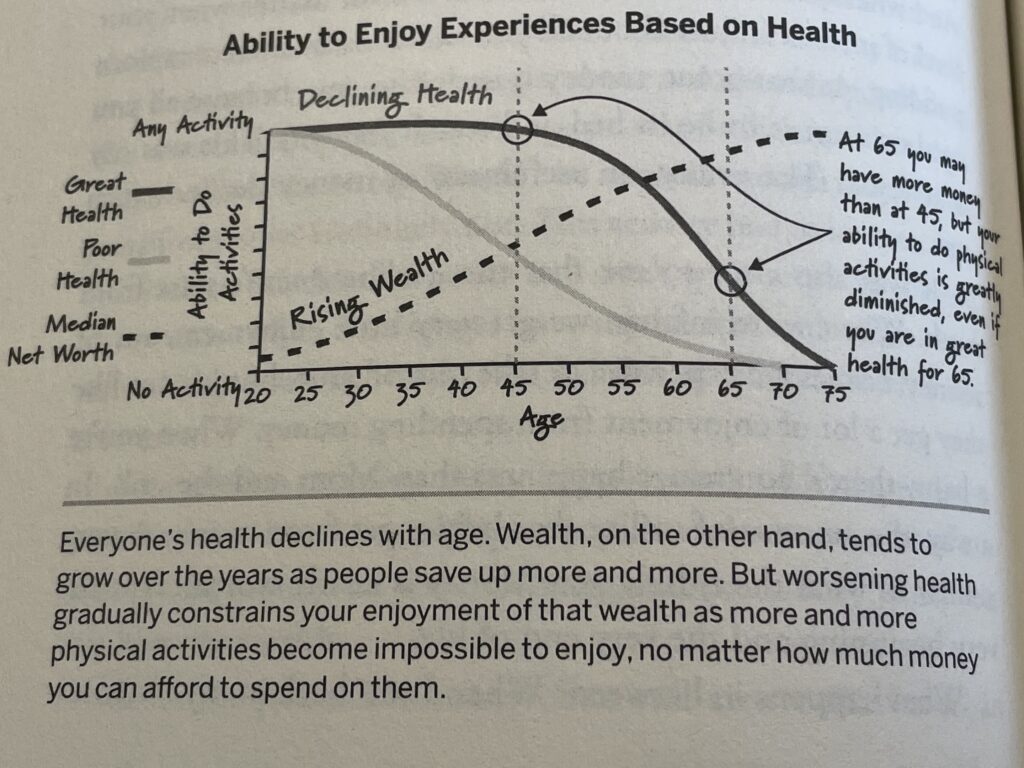

Source: Die With Zero: Getting All You Can From Your Money and Life

You can see this in the chart above and represents one of the main points from the book Die With Zero: Getting All You Can From Your Money and Life by Bill Perkins. In this short book, Perkins argues that we target spending all our money during our lifetimes will generate more positive and meaningful experiences along the way.* This he argues is a rich life. From the book:

“Why wait until your health and life energy have begun to wane? Rather than just focusing saving up for a big pot full of money that you will most likely not be able to spending in your life, live your life to the fullest now: Chase memorable life experiences, give money to your kids when they can best use it, donate money to charity while your still alive. That’s the way to live life.”

This is a very different mindset than most people currently have. It implies you should spend more money earlier during your lifetime in order to best enjoy it and produce a lifetime full of memories. As Perkins notes, this need not mean you engage in hedonistic behavior, but it does mean being more generous to your future self.

The EBRI study shows that many Americans feel very comfortable maintaining, or even growing, their assets in retirement. As my colleague Kris Venne notes going from a saving to a spending mindset is an ‘epic shift.’ It may very well take a pandemic to prompt wholesale behavioral changes for Americans reluctant to spend down their assets.