Quote of the Day

"If you allow the past – in investing or out of it – to consume you, you will never create the future you want and deserve."

(Vishal Khandelwal)

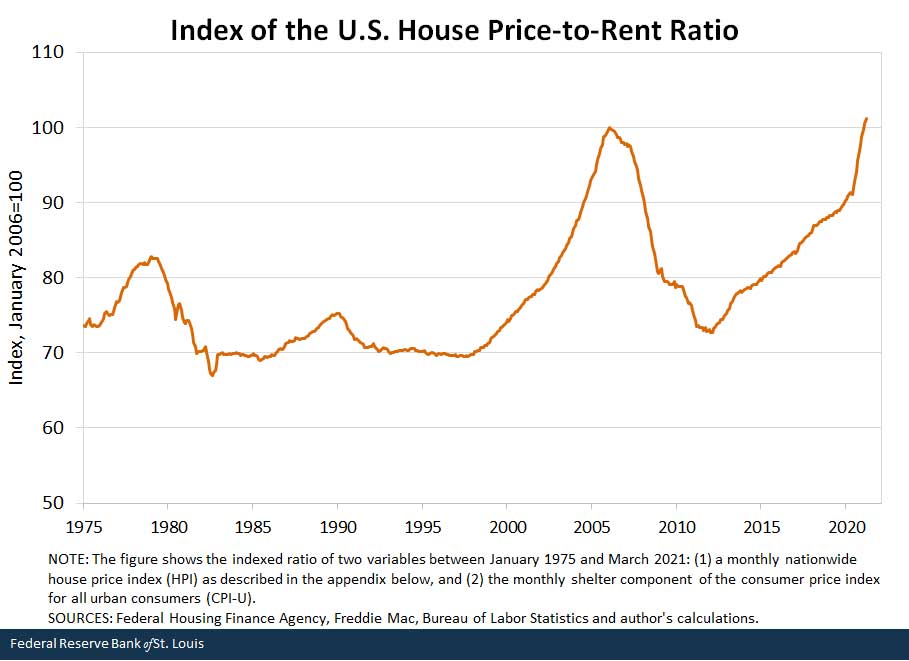

Chart of the Day

This indicator shows an overheated housing market. (chart via St. Louis Fed)

Bonds

- Why it's hard to get excited about bonds today. (morningstar.com)

- The amount of negative-yield global bonds are in decline. (msn.com)

- Where one model says the 10-year Treasury should be trading. (capitalspectator.com)

Crypto

- Four lessons from the Crypto Crash including 'The 24/7 nature of crypto markets exacerbates volatility during a crisis.' (awealthofcommonsense.com)

- Why crypto gets way more attention than it deserves. (pragcap.com)

- Crypto talk on Reddit now outpaces WSB. (ft.com)

Startups

- Startup valuations are soaring. (tomtunguz.com)

- Making the case for late-stage capital and startups staying private longer. (bothsidesofthetable.com)

Fund management

- Why hedge fund performance fell off the table, post-GFC. (institutionalinvestor.com)

- The iShares MSCI USA Momentum Factor ETF ($MTUM) is set for a lot of turnover. (finance.yahoo.com)

Work

- Warehouses are upping their spending on automation equipment. (wsj.com)

- The pandemic was the last straw for many restaurant workers. (washingtonpost.com)

Housing

- The March Case-Shiller numbers showed a 12.3% annual increase in national home prices. (calculatedriskblog.com)

- What the recent data tell us about the inflection point for housing. (bonddad.blogspot.com)

- It's not just home builders who are struggling with higher lumber prices. (wsj.com)

- An increasing number of offers are for all-cash. (thebasispoint.com)

Inflation

- Post-WWII the U.S. also saw a big surge in inflation, due in part to supply issues. (ft.com)

- What assets serve best as an inflation hedge? (ft.com)

Earlier on Abnormal Returns

- Research links: market illusions. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: increased relevance. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)