Quote of the Day

"The fund industry is a supertanker. Its turns are almost imperceptible. This sluggishness occurs not only because the industry is mature, such that existing assets dwarf the amount of annual sales, but also because old habits die hard."

(John Rekenthaler)

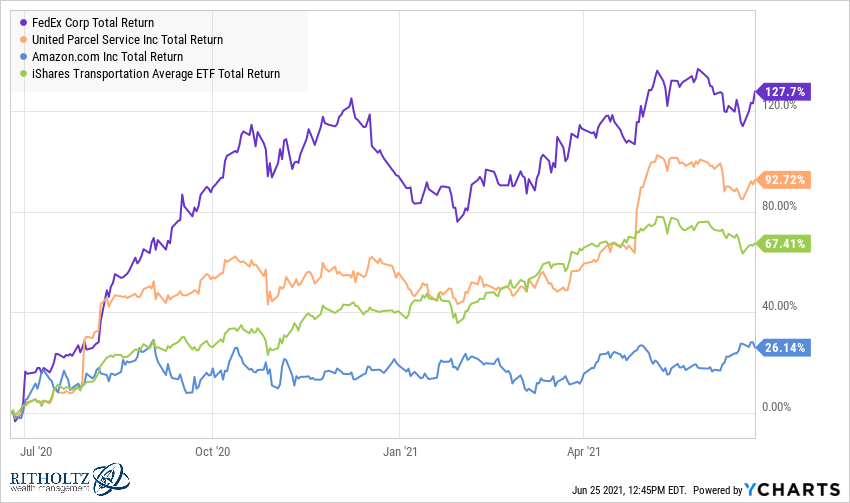

Chart of the Day

FedEx ($FDX) announced it will up capital spending to keep up with rising demand. (chart via @ycharts)

Markets

- IPOs are the province of money-losing companies. (sentimentrader.com)

- What are you actually getting with mid cap stocks? (humbledollar.com)

Strategy

- You can prepare for risk, but you can't predict it. (awealthofcommonsense.com)

- Novel Investor, "The future is unknowable. Nobody has the power to foresee it. The solution is to ignore the fortunetellers and stay the course." (novelinvestor.com)

- Does it make sense to put an uber-volatile asset like Bitcoin into an IRA? (pragcap.com)

Companies

- BuzzFeed is going public via SPAC. (nytimes.com)

- Two companies have agreed to list on the Long Term Stock Exchange. (wsj.com)

- Amazon ($AMZN) is pushing further into the podcasting game with the acquisition of Art19. (variety.com)

- Comcast ($CMCSK) is desperate to beef up its streaming offerings. (wsj.com)

Travel

- Amsterdam is re-thinking tourism, post-pandemic. (fastcompany.com)

- Venetians enjoyed a year without cruise ships. (ft.com)

- Ski resorts are prepared for another year of record summer visitors. (nytimes.com)

Economy

- The NBER is soon likely to call an end to the recession. (bonddad.blogspot.com)

- What does anyone care what Larry Summers thinks? (ritholtz.com)

Earlier on Abnormal Returns

- Podcast links: smart thinking. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: Wall Street whistleblowers. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)