Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at inflation hedges that don’t hedge all that much.

Quote of the Day

"Trend followers focus on the past, yet there is clear intellectual honesty in their analysis and a clear focus on the future. There is no misrepresentation. Past prices are turned into trend signals. There is no deep narrative."

(Mark Rzepczynski)

Chart of the Day

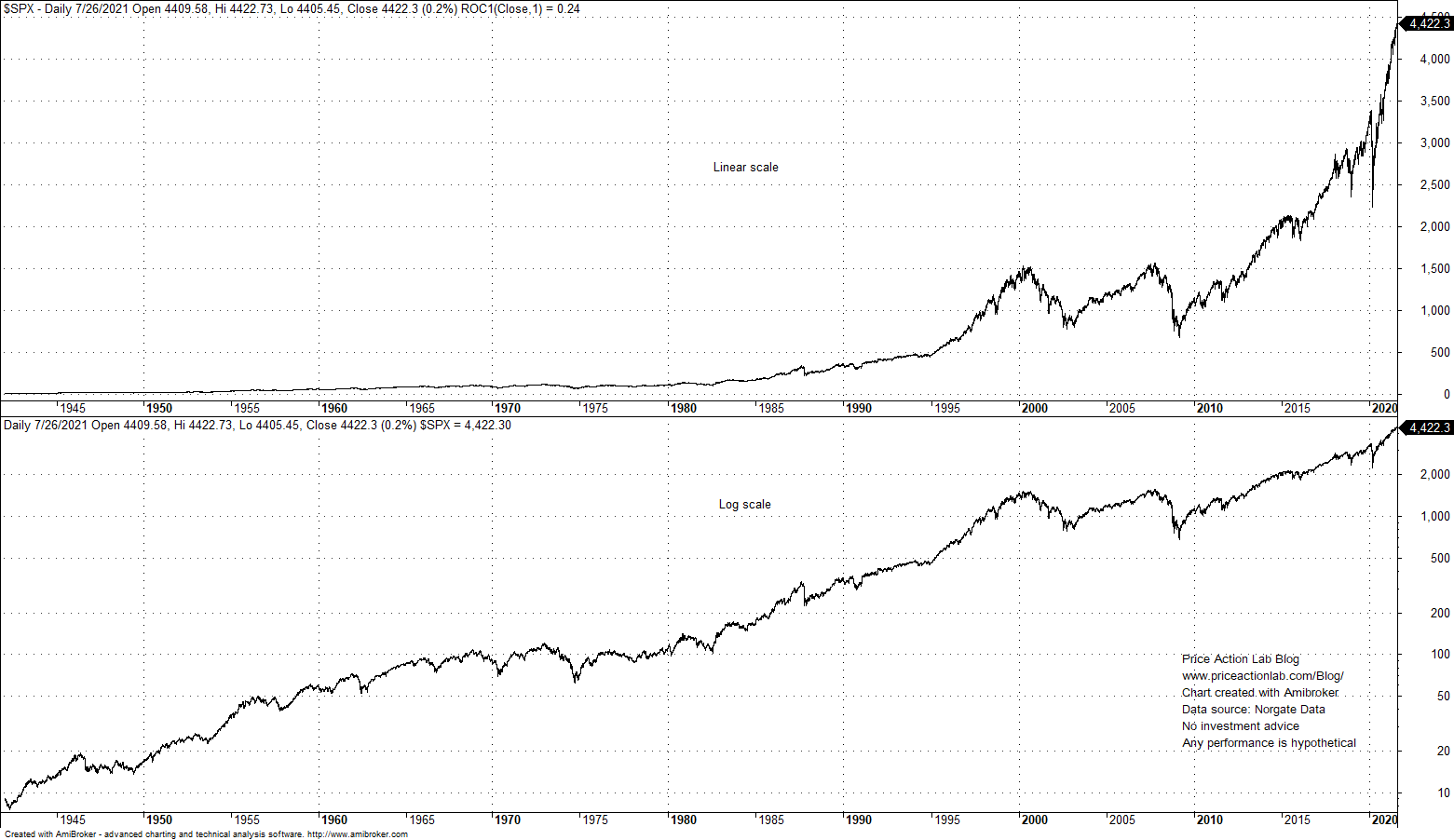

Over long periods of time using linear vs. log charts makes a big difference.

Funds

- Hedge funds don't really hedge anymore. (mailchi.mp)

- There's not much evidence in favor of thematic/specialized ETFs. (evidenceinvestor.com)

Strategy decay

- Why (and how) systematic strategies decay over time. (evidenceinvestor.com)

- Why regime changes can only be known in hindsight. (klementoninvesting.substack.com)

Research

- A look at what really drives interest rates. (aqr.com)

- On the performance of 'sin stocks.' (alphaarchitect.com)

- Is there a rebalancing bonus? It depends. (occaminvesting.co.uk)

- Why are portfolio managers so much better are buying than selling stocks? (papers.ssrn.com)

- A round of the past month's white papers including 'Do CLOs deserve a spot in a diversified portfolio?' (bpsandpieces.com)