Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at how growing retail participation is messing with quant models.

Quote of the Day

"Although creating a disciplined and systematic approach to vetting managers using deliberate thinking can in fact create a repeatable process, the accuracy of the selection process — or the investment returns as output — can probably be improved by including the use of experiential judgment."

(Christopher Schelling)

Chart of the Day

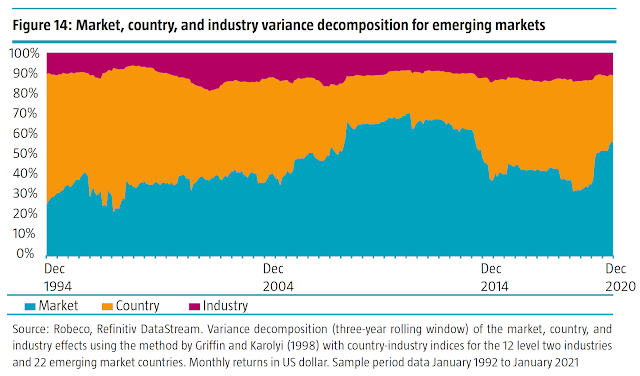

Emerging market still have a lot of single country risk relative to developed markets.

Factors

- Factors work in fixed income and explain a big chunk of excess returns. (institutionalinvestor.com)

- Does valuation tell us anything about relative factor returns? (blog.validea.com)

- Factors can help tell you what a portfolio manager actually does. (mrzepczynski.blogspot.com)

Research

- How efficiently is goodwill priced by the stock market? (alphaarchitect.com)

- Thematic ETFs, on average, hold growth stocks that invest now for future profitability. (papers.ssrn.com)

- Time frame matters a lot when it comes to risk management. (capitalspectator.com)

- Does media coverage provide any information about the success of merger deals? (alphaarchitect.com)

- A good reminder to take your vacation time. (klementoninvesting.substack.com)