Mondays are all about financial adviser-related links here at Abnormal Returns. You can check out last week’s links including a look at the highest priorities for RIA leaders.

Quote of the Day

"Financial advisors sold products. Financial Advicers sell themselves, their expertise, and their process that helps clients follow through on that advice to make sure the advice actually sticks. Which necessitates deeper expertise."

(Michael Kitces)

Chart of the Day

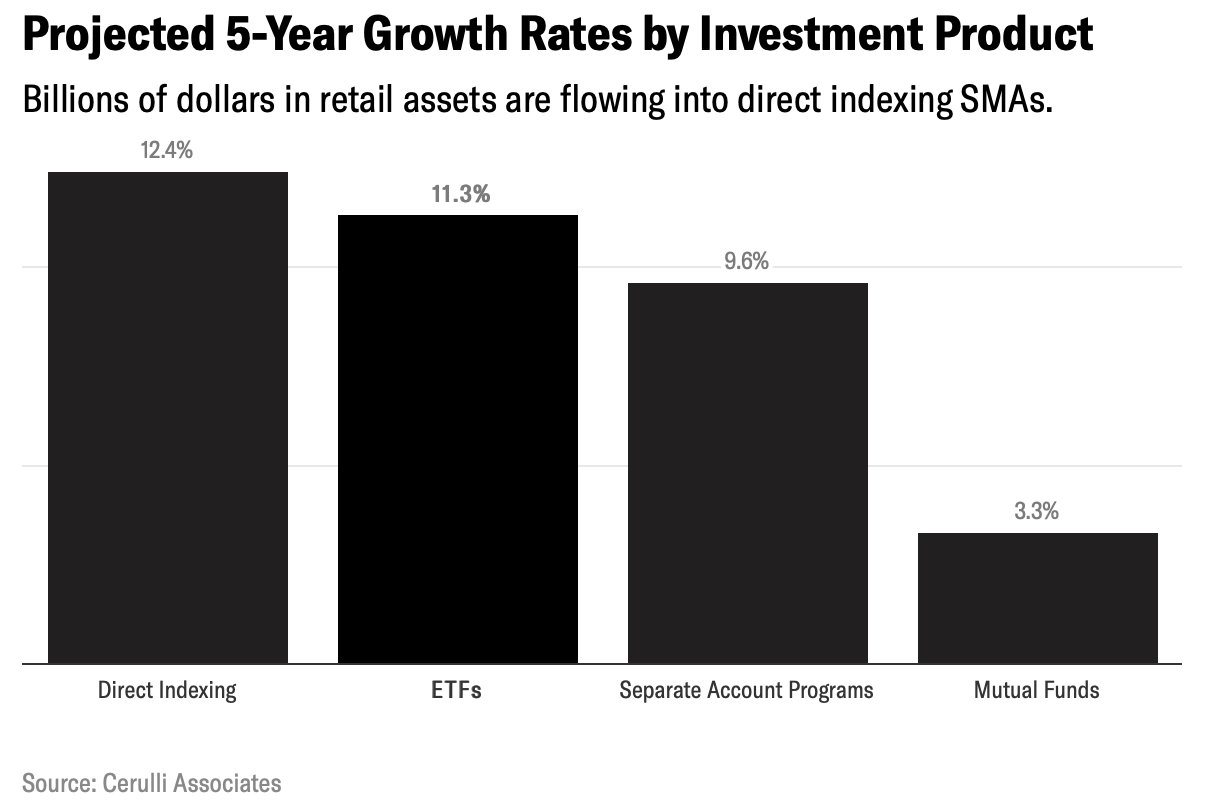

Growth in direct indexing is expected to outpace growth in SMAs and ETFs.

Podcasts

- Brendan Frazier talks with Natalie Taylor of Monarch Money about switching from a goals-based approach to a values-based approach to planning. (wiredplanning.com)

- Michael Kitces and Carl Richards talk about the challenge in transferring trust among advisers in a firm. (kitces.com)

The biz

- How Vanguard Personal Advisor Services plans to use the firm's new exclusive, actively managed offerings. (riabiz.com)

- Morningstar ($MORN) is apparently jumping into the direct indexing space. (ft.com)

- Schwab Advisor Services is pulling back from in-person events this Fall. (riabiz.com)

Compliance

- Compliance officers are focusing on the new SEC marketing rules. (investmentnews.com)

- Does your firm have a plan to deal with a cyberattack? (investmentnews.com)

Advisers

- When an adviser retires you essentially need to re-onboard the client. (marketwatch.com)

- Why you should plan for higher Social Security payroll taxes. (thinkadvisor.com)

- Vanilla aims to make estate planning super simple. (riabiz.com)

- The latest goings on in advisor technology including the launch of Fabric RQ. (kitces.com)

- Why we need a national 401(k) plan. (morningstar.com)