Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at what happens when a stock is at or near its 52-week high.

Quote of the Day

“Step one in dealing with the replication crisis in finance is to accept that there is a crisis. And right now, many of my colleagues are not there yet.”

(Campbell Harvey)

Chart of the Day

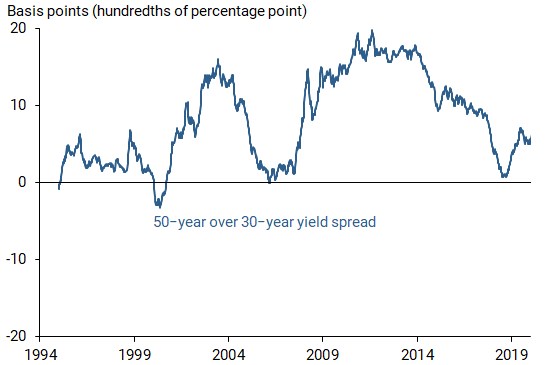

An estimate on how much more would 50-year Treasury bonds yield over 30-year bonds.

Quant stuff

- Some career advice for people trying to get into the quant/derivatives world. (notion.moontowermeta.com)

- Another spin on the 'hot hand' effect. (marginalrevolution.com)

Changing assumptions

- Why portfolio turnover is not the drag it used to be for strategies. (albertbridgecapital.com)

- Why the illiquidity premium is not really a thing in public markets. (alphaarchitect.com)

Factors

- Is sector-neutrality a mistake in factor investing? It depends whether you running a long-only or long-short book. (papers.ssrn.com)

- The momentum factor is driven by bias, not risk. (alphaarchitect.com)

- What is the best way to combine factors in a portfolio? It depends. (blog.validea.com)

- Factors are becoming the default way institutional investors think about portfolios. (institutionalinvestor.com)

- A deep dive into factor investing with Jack Vogel of Alpha Architect. (alphaarchitect.com)

Forex

- Have you noticed nobody really talks about FX volatility any more? (mailchi.mp)

- The returns to FX factors over the past decade has been not great. (mailchi.mp)

Research

- A look at the historic returns to SPACs. (caia.org)

- Just because an ETF follows an index doesn't mean it is truly 'passive.' (papers.ssrn.com)

- There is very little evidence that tactical asset allocation funds generate any alpha. (evidenceinvestor.com)

- Evidence from a earlier bubble show speculators with 'time, money and opportunity' didn't perform well. (papers.ssrn.com)

- Married CEOs take less risk. (papers.ssrn.com)