Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why selling option isn’t ‘passive income.’

Quote of the Day

"It’s a complex world out there, and humans are deluged with haphazard and indiscriminate information. Recognizing patterns from incomplete data is a way of simplifying our habitat, making it manageable — and sometimes staying alive."

(Matthew Brooker)

Chart of the Day

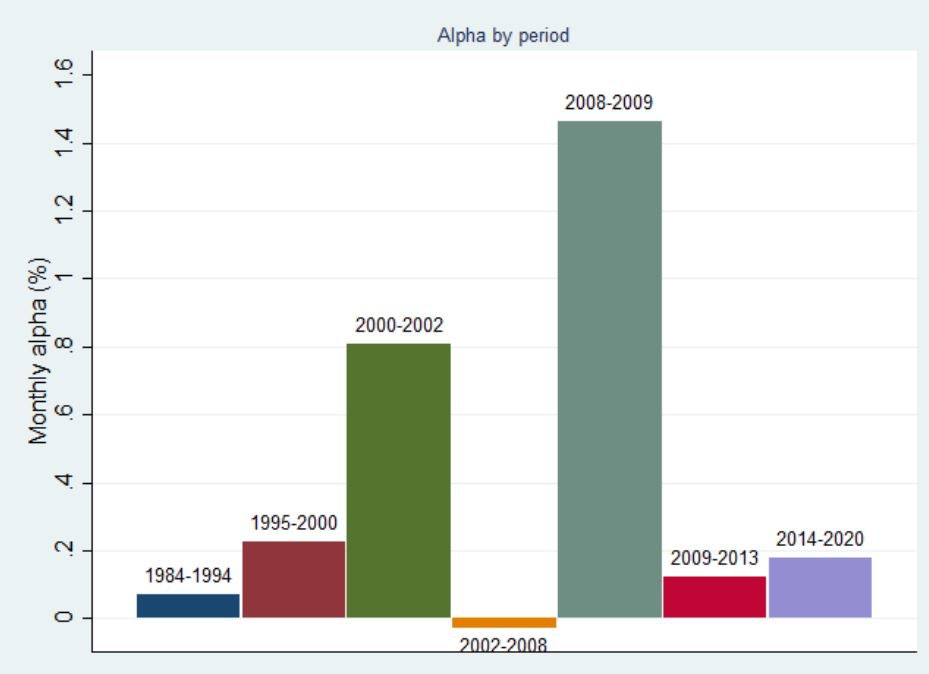

Employee satisfaction remains a driver of stock market outperformance.

Returns

- Does total shareholder return overstate the aggregate returns to investors? (papers.ssrn.com)

- An examination of stock market returns from before 1926. (papers.ssrn.com)

Retail

- Research showing that PFOF is not putting retail investors at a disadvantage. (papers.ssrn.com)

- Retail investors pay more attention to local companies. (papers.ssrn.com)

Quant stuff

- Capture ratios are overrated. (evidenceinvestor.com)

- Financial research depends, in part, on the researchers doing the work. (alphaarchitect.com)

Research

- Does the research showing that most stocks underperform over their life negate the value of active management? (alphaarchitect.com)

- How the state of volatility affects equity market returns. (insights.factorresearch.com)

- Value, size, profitability, and investment factors were meh in a sample of international markets. (alphaarchitect.com)

- New accounting standards can mess with quant models. (papers.ssrn.com)

- A look at the performance of the Freedom 100 EM Index. (institutionalinvestor.com)

- How shared alumni connections affect startup funding. (institutionalinvestor.com)