Quote of the Day

"Perhaps you can imagine what a crash is like, but only those who have lived through it truly understand the intensity and magnitude of the experience."

(Barry Ritholtz)

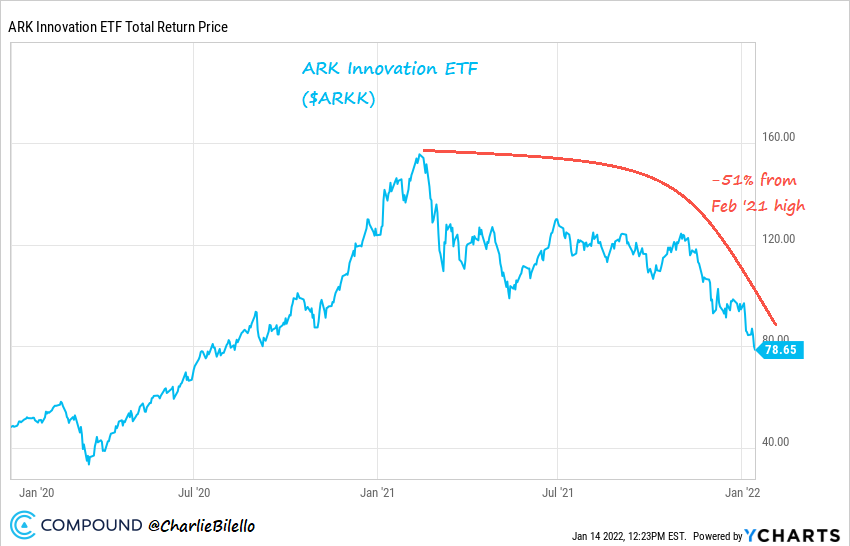

Chart of the Day

It’s been a rough year, or so, for the ARK Innovation Fund ($ARKK). (via @charliebilello)

Markets

Strategy

- Buying a dip in the stock market vs. an individual stock are two different things. (awealthofcommonsense.com)

- More investing lessons from 2021 including 'Don’t let your political views influence your investment decisions.' (evidenceinvestor.com)

- NI, "Keep in mind, investing is not about being right, it’s about not digging yourself into a deep hole and making it harder to make money." (novelinvestor.com)

Crypto

- How correlated are web2 and web3? (tomtunguz.com)

- FTX has launched a $2 billion venture fund. (blockworks.co)

- Why buy an NFT? (bpsandpieces.com)

Venture

- Chicago startups have carved out a niche in technology services. (bloomberg.com)

- A surprising amount of venture capital has gone into underwear startups. (news.crunchbase.com)

- Want to pitch a16z? Make sure it's Lindy. (protocol.com)

- The state of venture capital, 2021. (ritholtz.com)

Finance

- Big banks are upping their compensation. (bloomberg.com)

- The pandemic economy has been good for CLOs. (institutionalinvestor.com)

Funds

- What the story of the Fidelity Magellan fund tells us about how markets evolved. (morningstar.com)

- Blackrock ($BLK) has crossed $10 trillion in AUM. (etf.com)

Earlier on Abnormal Returns

- Podcast links: surprising lessons. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: venting vs. inventing. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)