Quote of the Day

“The active exodus is really out of stock pickers...People are just not into paying a legacy money manager, especially the closet indexers. That’s as close as anything to an endangered species.”

(Eric Balchunas)

Chart of the Day

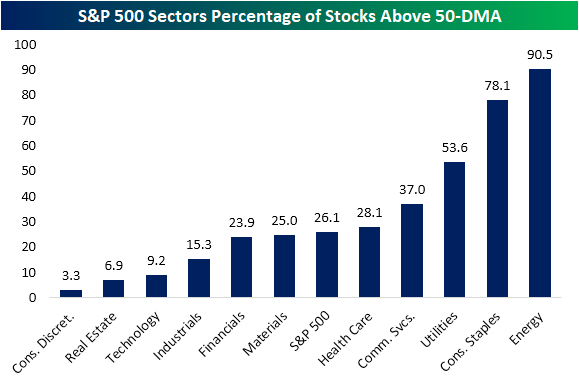

This correction is taking its toll on consumer discretionary and tech stocks. (via @bespokeinvest)

Markets

- Big selloffs are driven, in part, by players who HAVE to sell. (thereformedbroker.com)

- It's hard to ignore the round-trip many growth stocks have made. (awealthofcommonsense.com)

- The bloom is off the WallStreetBets rose. (wsj.com)

Strategy

- It's not enough to recognize that stocks can go down. You have to internalize it. (theirrelevantinvestor.com)

- Sam Ro, "If you’re not able to stomach short-term volatility or if your portfolio can’t handle short-term unrealized losses, then investing in the stock market might not be for you." (tker.co)

- If you are confused now, you probably didn't have a plan to start. (allstarcharts.com)

Crypto

- Why celebrities endorse crypto. (slate.com)

- Crypto proponents have not done the industry any favors. (integratinginvestor.com)

Funds

- You can't rely on a fund manager to tell you which funds are best held in an IRA. (wsj.com)

- Nicholas Raebner, "Although ETFs are great tools for investors, their original underlying purpose has been corrupted." (insights.factorresearch.com)

- Hedge funds have had a good three-year run but have lagged the stock market. (bloomberg.com)

Earlier on Abnormal Returns

- A market correction reading list from Josh, Michael, Ben and Barry. (abnormalreturns.com)

- Adviser links: the 3 percent rule. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- The most-read items last week on the site. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)