Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at when ETF tax-efficiency can go wrong.

Quote of the Day

"While quants thoroughly test the algorithmic decisions their models make, they tend not to apply the same objective and rigorous analysis to their human decisions."

(Clare Flynn Levy)

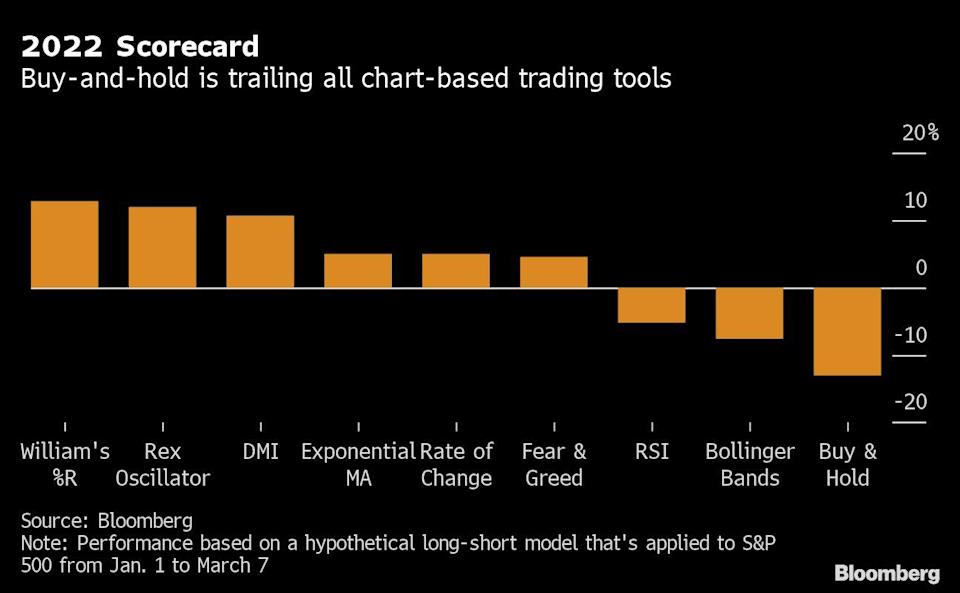

Chart of the Day

In a down year, every technical indicator is going to outperform buy-and-hold.

Commodities

- What you need to know about farmland investing. (caia.org)

- A good reminder: a commodity ETF may not provide the exposure you think you are getting. (insights.factorresearch.com)

Research

- How changing accounting standards affect quant returns. (alphaarchitect.com)

- How quants and fundamental analysts can find common ground. (blogs.cfainstitute.org)

- Measuring intangibles is an ongoing project. (alphaarchitect.com)

- Fund managers are just as likely to exhibit sell winners and hold losers. (evidenceinvestor.com)

- The 2022 Credit Suisse Global Investment Returns Yearbook is here! (abnormalreturns.com)

- What it's like to build trading systems using Composer. (theirrelevantinvestor.com)