Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at using trending following on Bitcoin.

Quote of the Day

"All factors, no matter how strong their historical performance is, will have long periods where they don’t work. Blending uncorrelated factors is the closest thing to a free lunch you will see in factor investing. I wish I had recognized that earlier."

(Jack Forehand)

Chart of the Day

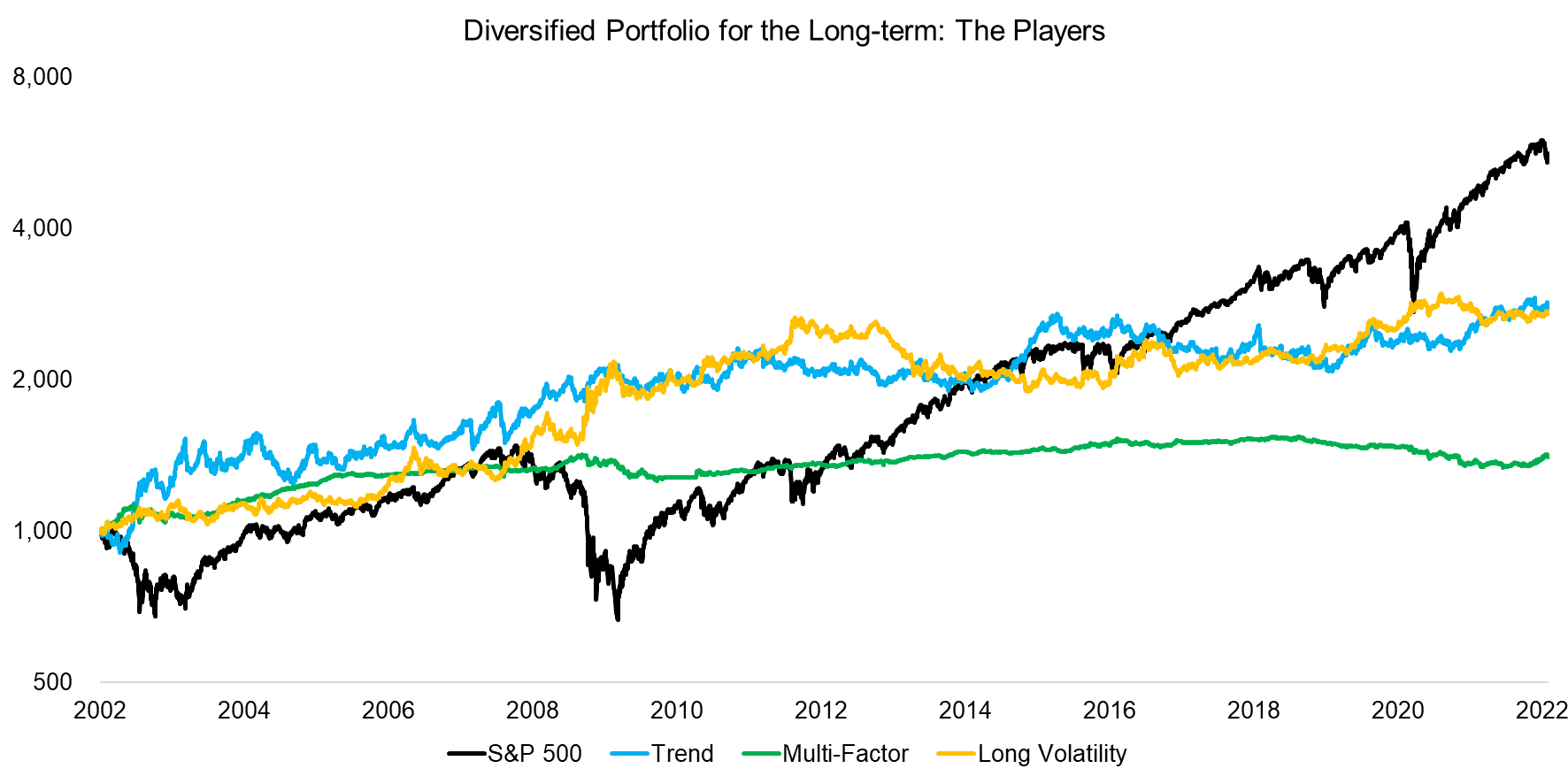

Factor strategies, even optimized, have had a hard time keeping up with the S&P 500.

Behavior

- Men are more likely to panic sell than women. (evidenceinvestor.com)

- The disposition effect is stronger in bear markets. (klementoninvesting.substack.com)

Research

- Employee satisfaction matters for stock returns but are difficult to measure. (alphaarchitect.com)

- Five mistakes from a life in quant including 'Relying too much on single factors.' (blog.validea.com)

- Why volatility should not be considered an asset class. (elmwealth.com)

- Even predictable cash flows can affect stock prices. (alphaarchitect.com)

- Insider trading is nothing new. (quantpedia.com)