Wednesdays are all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at ways to mitigate sequence of returns risk.

Quote of the Day

"Running a simple portfolio is indeed simple. But financial planning involves a lot more than just running a portfolio."

(Mike Piper)

Chart of the Day

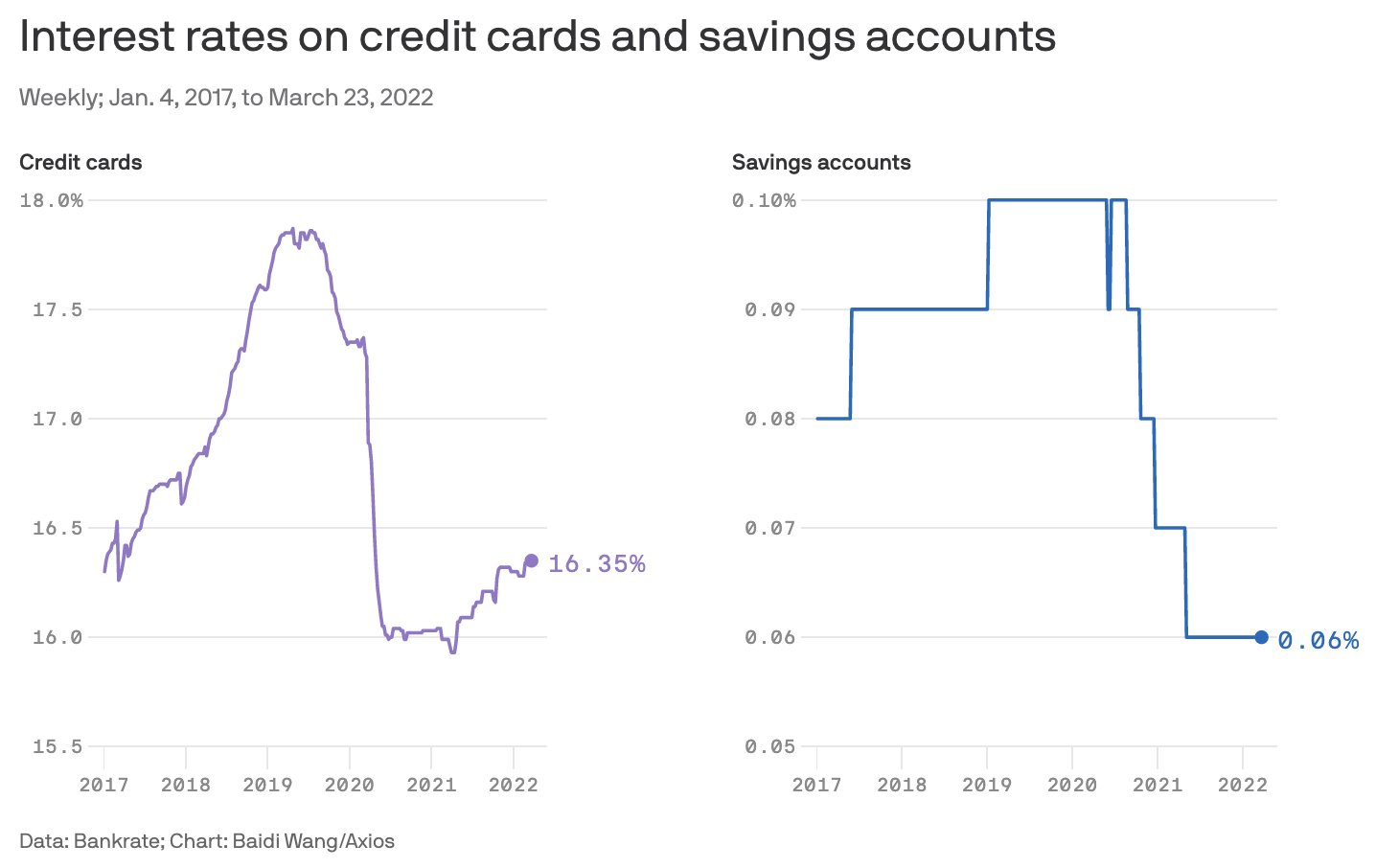

Interest rates are on the rise, but banks are not raising rates on savings accounts.

Housing

- The flip side of a hot housing market: a profit windfall. (humbledollar.com)

- Rising home prices put more people at-risk of paying capital gains taxes. (nytimes.com)

- There are some definite upsides to renting and not buying a house. (whitecoatinvestor.com)

- Not everybody downsizes their home in retirement. (wsj.com)

Retirement

- Why you should consider a gradual retirement model. (humbledollar.com)

- A phased retirement plan requires some planning. (wsj.com)

- Retirement planning isn't just financial. (rogersplanning.blogspot.com)

- Why it makes sense to take test run before retiring. (evidenceinvestor.com)

Investing

- Why individual investors don't need to trade options. (elmwealth.com)

- Stock market games teach students the wrong lessons. (wsj.com)

- Why investors should embrace mediocrity. (tonyisola.com)

- Fidelity tops the Barron's list of the best online brokers for 2022. (barrons.com)

Personal finance

- What status game are you playing? (ofdollarsanddata.com)

- You need to simultaneously take care of your future self and present self. (physicianonfire.com)

- On the difference between a fee and a fine. (thriveglobal.com)

- Why so many adults are still on their parents' phone plans. (wsj.com)

- Health insurance is only getting more complicated. (humbledollar.com)

- Please don't die without a will. (nextavenue.org)