Quote of the Day

"People often say that 40 years of falling rates made investors look smart. But was it falling rates that made investors look smart or was it 40 years of disinflation that made investors looks smart?"

(Cullen Roche)

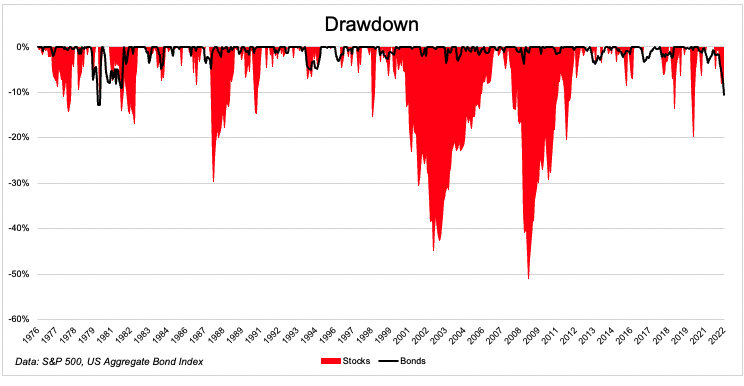

Chart of the Day

Bonds are not holding up their side of the portfolio bargain this year.

Markets

- How the growth stock meltdown resembles the Nifty Fifty era. (awealthofcommonsense.com)

- The stocks that should be hurt, are getting hurt. (novelinvestor.com)

- If Twitter ($TWTR) was such a bargain, why hadn't someone else already bid for it? (slate.com)

- Ten thoughts on Twitter as a platform, and why it's so hard to quit. (theconvivialsociety.substack.com)

Companies

- The supply chain constraints are real for Apple ($AAPL). (macworld.com)

- What's holding back the market for anti-obesity drugs? (wapo.st)

- Why Netflix ($NFLX) hit the subscriber wall. (visualcapitalist.com)

Credit

- Mortgage refinancing has ground to a halt with 5% rates. (housingwire.com)

- Personal loan volume is back on the rise after a pandemic pause. (wsj.com)

Fund management

- Why Bitcoin doesn't belong in 401(k) plans. (morningstar.com)

- Where Vanguard goes, cost compression follows. (bloomberg.com)

Economy

- Why the fall in Q1 GDP doesn't indicate a recession on the horizon. (econbrowser.com)

- Las Vegas is coming back, but isn't all the way there yet. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Podcast links: building stuff that matters. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: Amazon logistics. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)