Quote of the Day

"A diversified portfolio, with the appropriate amount of risk to match your needs, is like a ship meant to survive all storms. But no one can save you if you jump out."

(Blair duQuesnay)

Chart of the Day

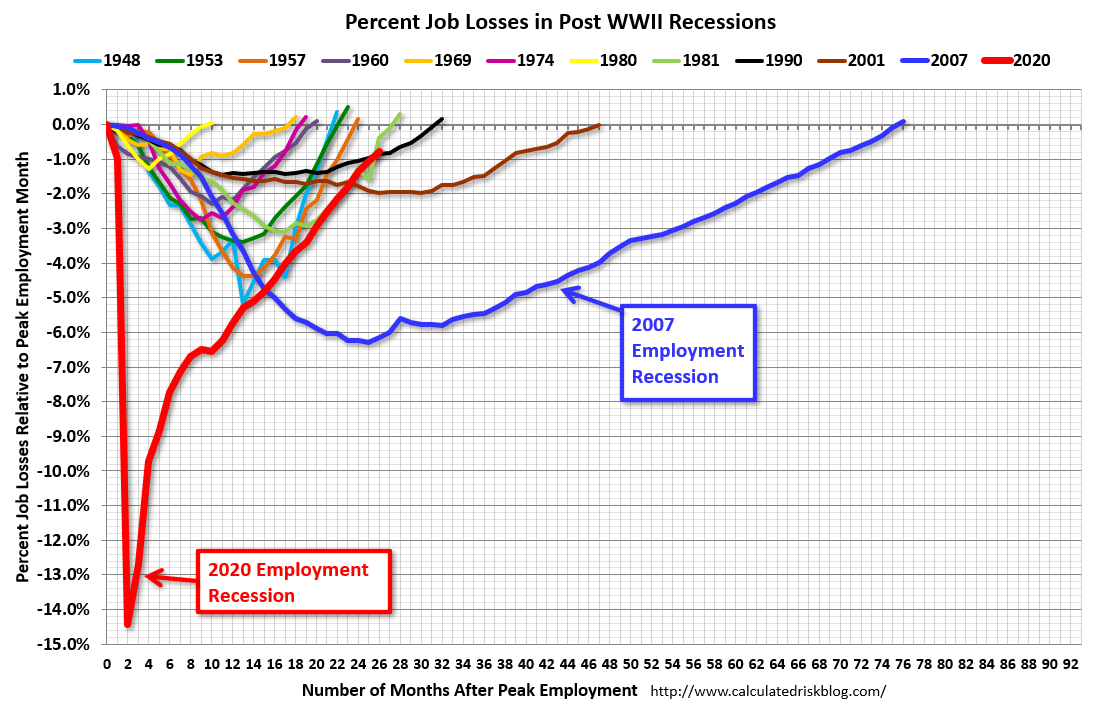

The U.S. employment economy has nearly recovered from the pandemic.

Strategy

- Diversification matters, especially in a downturn. (morningstar.com)

- Some timeless investing lessons learned during the Great Depression. (novelinvestor.com)

Bonds

- For the first time, in a long time, you can get some yield at the short end of the curve. (awealthofcommonsense.com)

- What has happened historically when stocks and bonds are both in a double-digit real drawdown. (bloomberg.com)

- It feels bad now, but a bond market reset was necessary. (wsj.com)

Companies

- IPOs are rare these days, but Bausch + Lomb ($BLCO) is now public. (wsj.com)

- Social media has seen a drop off in user growth from the pandemic boom. (variety.com)

- Startup layoffs are bleeding over into related sectors. (theinformation.com)

Hedge funds

- Which hedge fund strategies benefit from higher interest rates? (blogs.cfainstitute.org)

- Returns for Tiger Global and AQR are two side of a coin. (ft.com)

Economy

- The April NFP report showed a divergence between the establishment and household surveys. (bonddad.blogspot.com)

- Used vehicles prices fell in April. (calculatedriskblog.com)

- The Great Resignation is by no means over. (axios.com)

Earlier on Abnormal Returns

- Podcast links: the future of travel. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: abandoned beliefs. (abnormalreturns.com)

- There are plenty of investments you can put into your 'too hard pile.' (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)