The S&P 500 has officially entered a bear market.

The mainstream media is now paying attention.

What if we are all looking in the wrong place? The story this year isn’t the stock market, but the bond market. The chart below shows the unprecedented damage the aggregate bond market has seen year-to-date.

The US bond market is on pace for its worst year in history with a loss of 12.1%. This is 4x larger than the previous worst year in 1994 (-2.9%). pic.twitter.com/jPJ5gIKWp4

— Charlie Bilello (@charliebilello) June 14, 2022

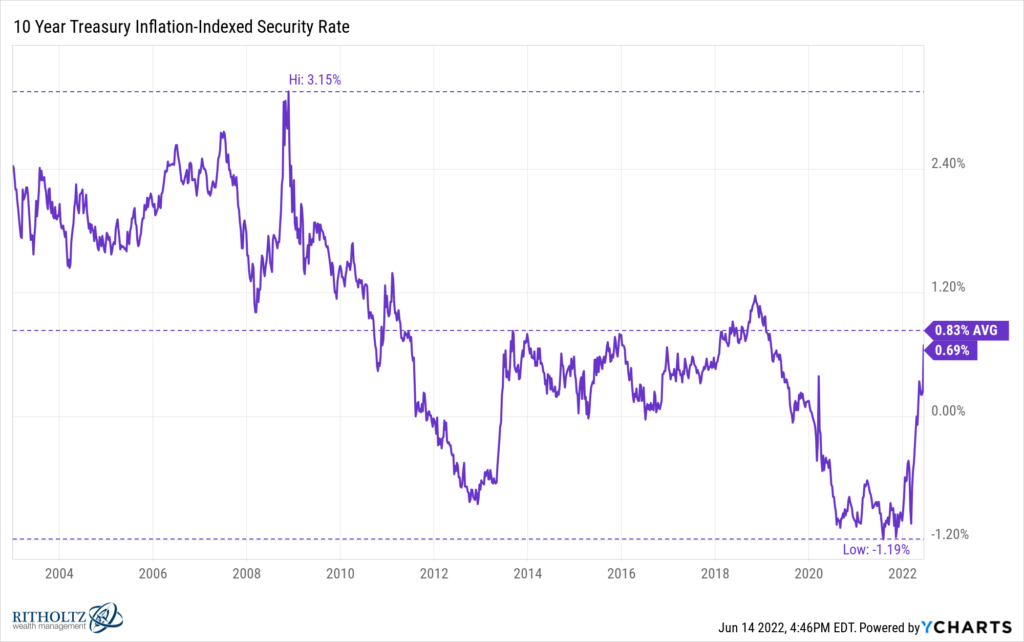

High, and unexpected, inflation is playing a big role in what is going on. Let’s strip out inflation and take a look at 10-year TIPS to get a better sense of things.

You can see that 10-year TIPS yields have bounced back from negative territory solidly into positive territory. Heck, we are only a bad day or two from getting back to the historical average.* The extraordinary situation that was 2020-21 has passed. The adjustment feels worse because it is happening so fast.

It may not feel like it now, but this is good news! Fresh capital that you put to work today has the prospect of earning higher returns than it would have a year ago. Yields can always rise farther. The stock market could continue to fall. But if you look out years, not days, investors have better prospects going forward.

*This chart has been updated to reflect yields through Monday (June 13th). On Tuesday, yields rose again pushing to the historical average.