Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at portfolio rebalancing is not a ‘free lunch.’

Quote of the Day

"A quantitative model will not have a memory bias. It will view positive and negative decisions the same."

(Mark Rzepczynski)

Chart of the Day

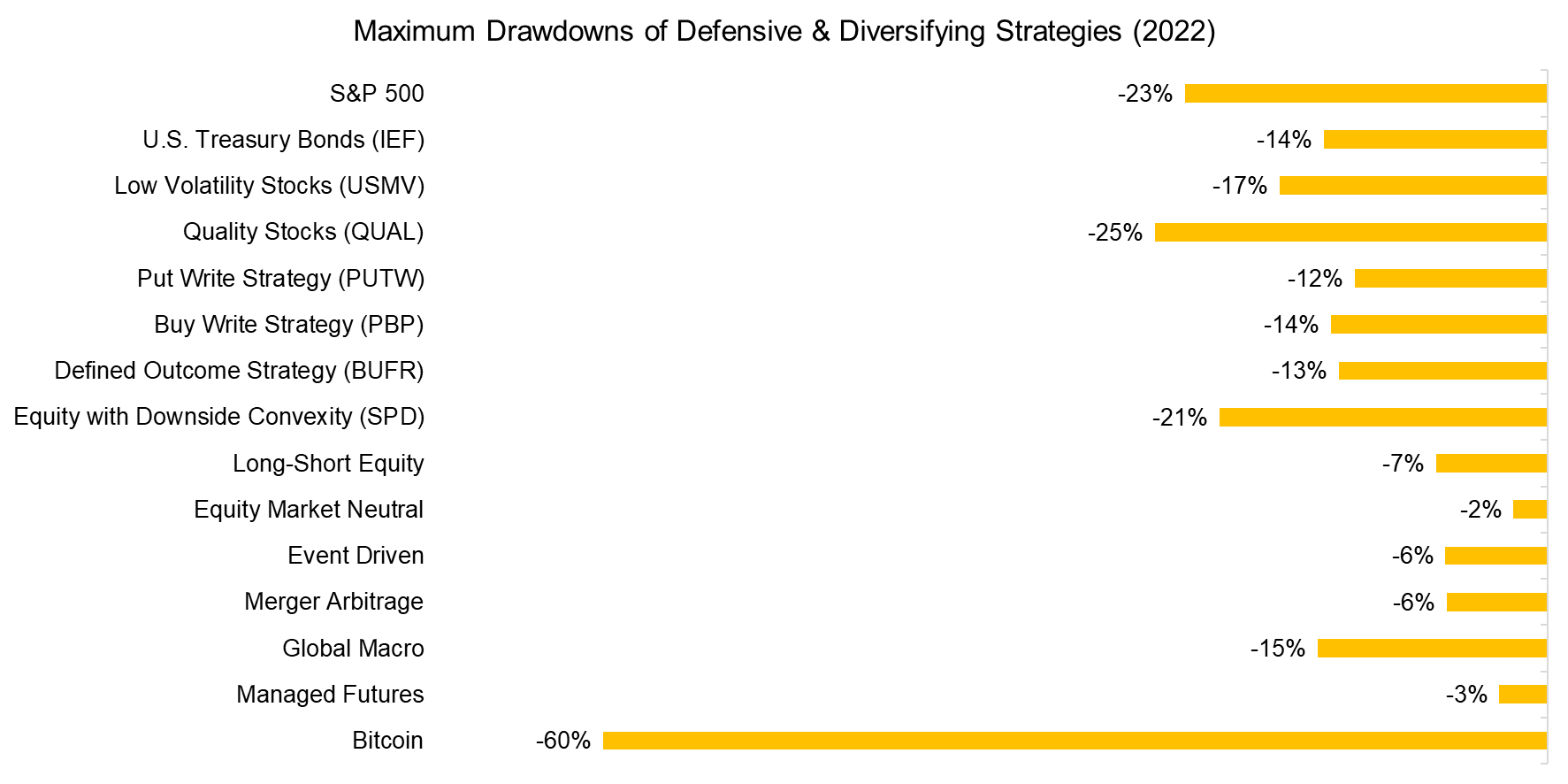

How various diversifying strategies have performed YTD.

Research

- Is the overnight effect the biggest anomaly hiding in plain sight? (elmwealth.com)

- How factors can be used in fixed income management. (mrzepczynski.blogspot.com)

- Don't use the CAPE ratio to time markets. (evidenceinvestor.com)

- When selecting mutual funds it matters more to avoid the worst funds than identifying the best. (alphaarchitect.com)

- Why public pension funds should adopt a one-size-fits-all portfolio or 'Universal Investment Portfolio.' (papers.ssrn.com)

- Are long/short strategies preferable to direct indexing when managing individual positions? (aqr.com)

- Comparing the performance of micro VCs and traditional VCs. (papers.ssrn.com)

- Robin Powell talks with Mario Klenzer and Gustav Tinghög about their research into who is at-risk of 'financial BS.' (youtube.com)