Quote of the Day

"Long tails drive everything. They dominate business, investing, sports, politics, products, careers, everything. Rule of thumb: Anything that is huge, profitable, famous, or influential is the result of a tail event."

(Morgan Housel)

Chart of the Day

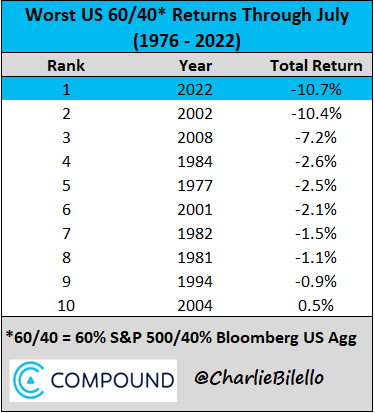

The YTD 60/40 portfolio returns are historically bad, but not as bad as they were through June. (via @charliebilello)

Markets

- Forward earnings estimates are coming down. (tker.co)

- Was the June bottom THE bottom? (awealthofcommonsense.com)

Companies

- What is Amazon's ($AMZN) best acquisition to-date? (trungphan.substack.com)

- A big leadership transition at Charles Schwab ($SCHW) is underway. (riabiz.com)

Trading

- CItadel has lost a battle with IEX over an order type. (bloomberg.com)

- FTX US is planning to launch stock options trading. (theblock.co)

Policy

- Allison Schrager, "Globalization is far from perfect, but on balance it does make our lives better." (bloomberg.com)

- Employment near retirement age is more cyclically sensitive. (papers.ssrn.com)

- America wastes money on a lot of stuff, but education isn't one of them. (noahpinion.substack.com)

- Fire departments are putting themselves out of business. (neddonovan.substack.com)

- Misinformation is big business. (nytimes.com)

Economy

- Inventory liquidators are busy. (nytimes.com)

- The stock market is betting the Fed is already looking at the end. (tker.co)

- How many Covid long haulers are out of the work force? (npr.org)

- The economic schedule for the coming week. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Top clicks last week on the site. (abnormalreturns.com)

- What you missed in our Saturday linkfest. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)