Quote of the Day

"Success in Silicon Valley is a dizzying combination of skill and luck, execution, and timing. But first and foremost, it is about people."

(Adam Nash)

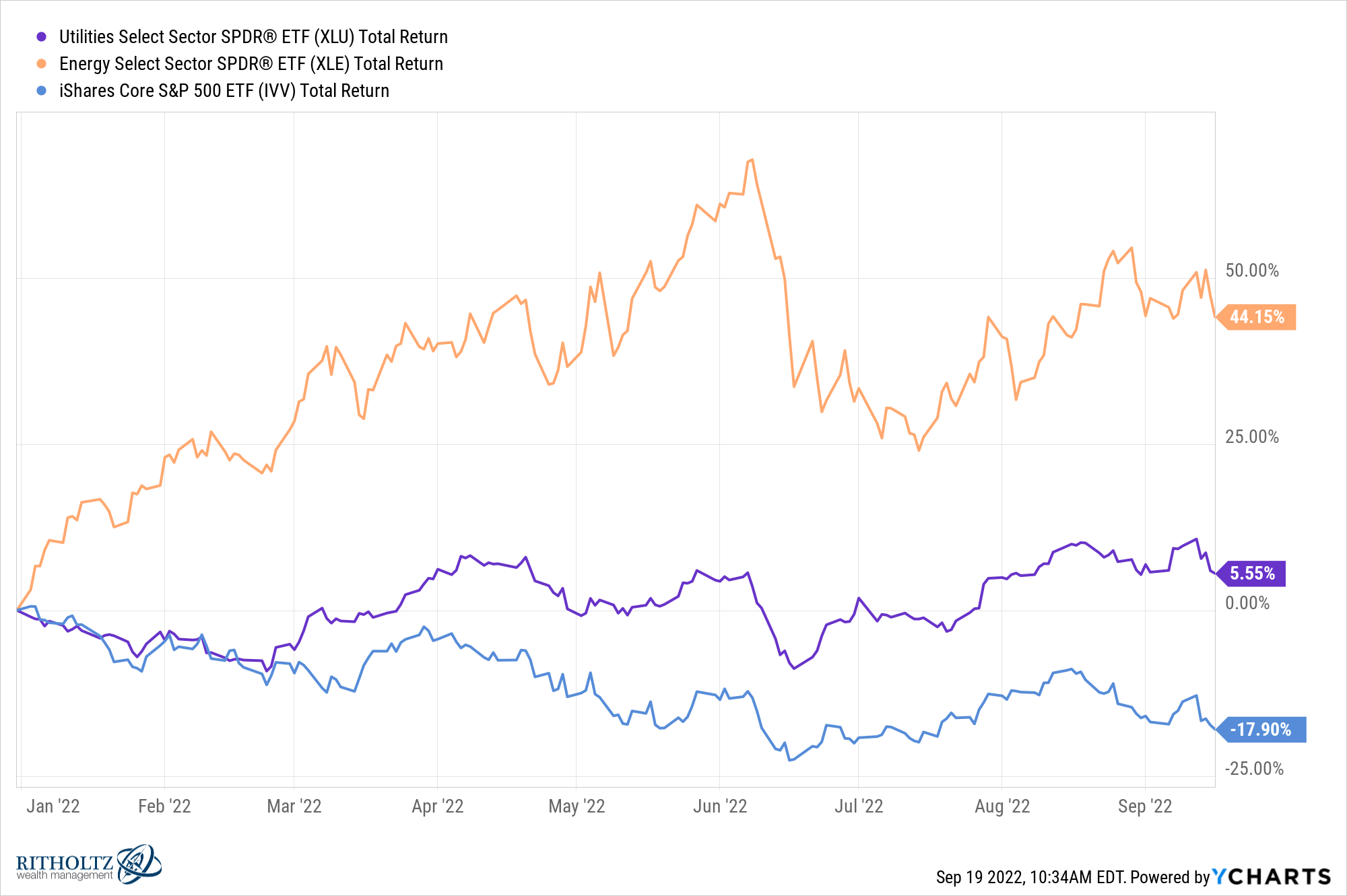

Chart of the Day

Utility stocks have eked out positive returns in 2022. (chart via @ycharts)

Markets

- Investors have just gotten hammered this year. (allstarcharts.com)

- The 10-year Treasury is at a decade long high. (markets.businessinsider.com)

- Gold is having a disappointing 2022. (wsj.com)

Strategy

- Michael Batnick, "Markets don’t move on good or bad, they move on better or worse, specifically better or worse than expected." (theirrelevantinvestor.com)

- The stock market doesn't care if you are watching. (awealthofcommonsense.com)

Companies

- Why Figma was worth $20 billion to Adobe ($ADBE). (hunterwalk.com)

- How new 'magical' technologies displace incumbents. (notboring.co)

- Companies are making it harder and harder to contact customer support. (ft.com)

- Why company culture matters. (onveston.substack.com)

Finance

- The U.S. is undergoing a historic IPO drought. (on.ft.com)

- Instacart is going allow employees to sell shares in a forthcoming IPO. (wsj.com)

- Private equity firms keep pouring money into stakes in pro sports franchises. (barrons.com)

- Primary deals are losing share in Treasury trading. (bloomberg.com)

Fund management

- ESG is oversold and ineffective. (wsj.com)

- Individuals are the final frontier for alternatives providers. (ft.com)

Global

- Energy prices have largely retraced their wartime boost. (bonddad.blogspot.com)

- Ukraine is going to need a reconstruction fund. (nytimes.com)

- Russia is pushing misinformation about global food insecurity. (nytimes.com)

Earlier on Abnormal Returns

- Adviser links: particular returns. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Top clicks last week on the site. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)