Quote of the Day

'No amount of money can compensate you for the misery of a toxic workplace."

(Joachim Klement)

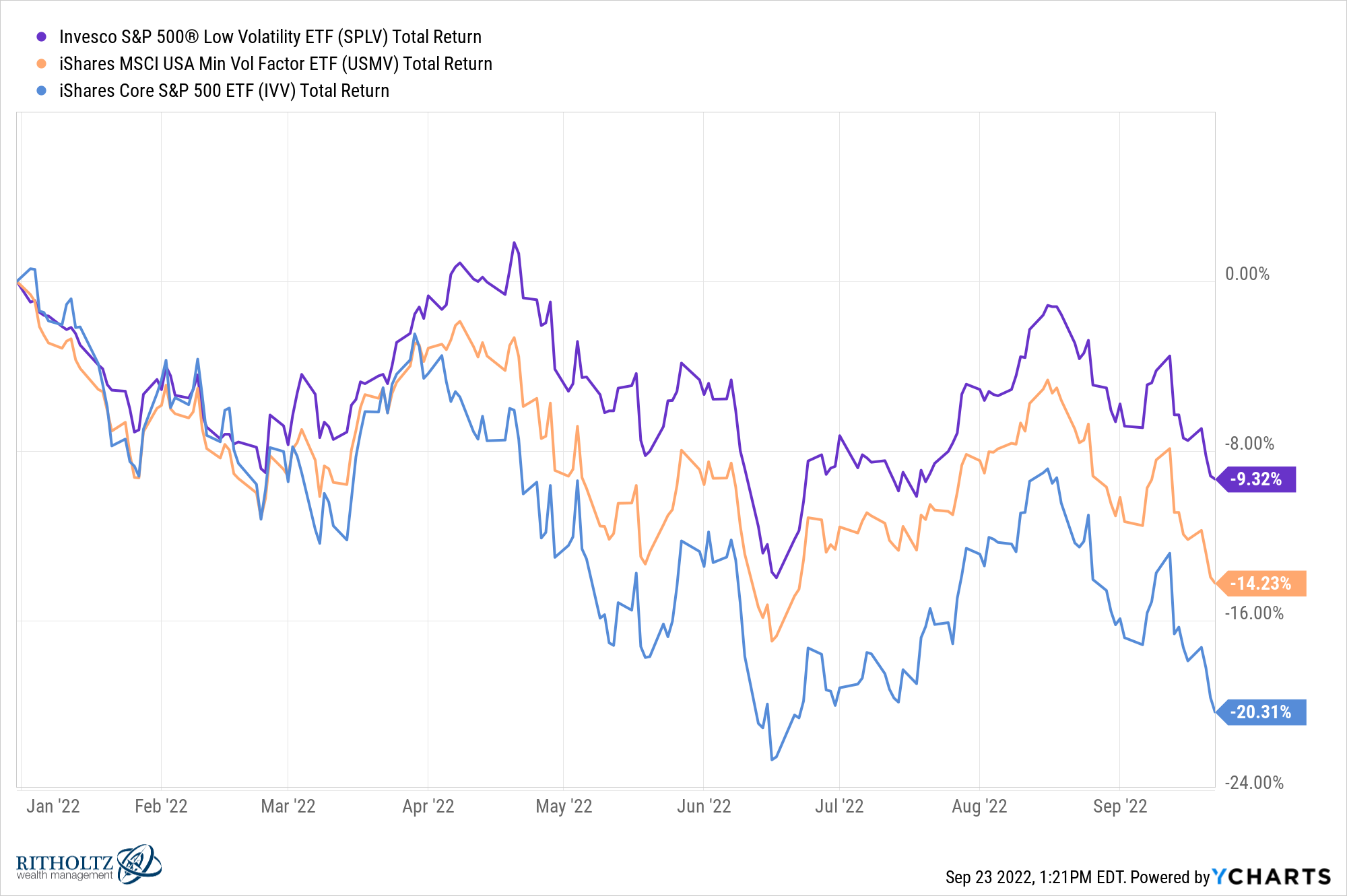

Chart of the Day

Low vol funds are attracting attention in the bear market. (chart via @ycharts)

Markets

- The very shortest end of the Treasury curve is not yet inverted. (bonddad.blogspot.com)

- Why it matters when the Fed stops raising rates. (capitalspectator.com)

Strategy

- Why it's important to make investment decisions before a bear market hits. (awealthofcommonsense.com)

- Consistency is an investing superpower. (novelinvestor.com)

Trading

- Retail investing is not going to become less 'democratized.' (slate.com)

- CME Group ($CME) is throwing spaghetti against the wall to see what sticks. (wapo.st)

Finance

- Why private equity is targeting the funeral home business. (californiahealthline.org)

- Empty office buildings are new abandoned malls. (bloomberg.com)

- Why Stripe may need to do an IPO even though it prefers not to. (theinformation.com)

Streaming

- What a Paramount+/Showtime combination means for smaller streamers. (variety.com)

- Netflix ($NFLX) is changing how it pays for standup comedy specials. (wsj.com)

- More signs that streaming subscriber growth is slowing. (variety.com)

Economy

- Joshua Brown, "Creating massive bubbles in one calendar year only to have to pop them in the following calendar year is irresponsible." (thereformedbroker.com)

- What's really going on with home inventory levels? (calculatedriskblog.com)

Earlier on Abnormal Returns

- Podcast links: nuclear misconceptions. (abnormalreturns.com)

- A home is a bundle of things, not just a house with a mortgage attached. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: cultivating understanding. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)