Quote of the Day

"We’ve now had two bear markets for the S&P 500 in less than three years. That’s the first time this has happened since the Great Depression."

(Ben Carlson)

Markets

- Mortgage rates are their highest level in 16 years. (bloomberg.com)

- Three reasons why international stocks have been such a big disappointment. (morningstar.com)

Strategy

- Why selling after a 25% decline has historically been a bad idea. (theirrelevantinvestor.com)

- When in doubt, rebalance. (blogs.cfainstitute.org)

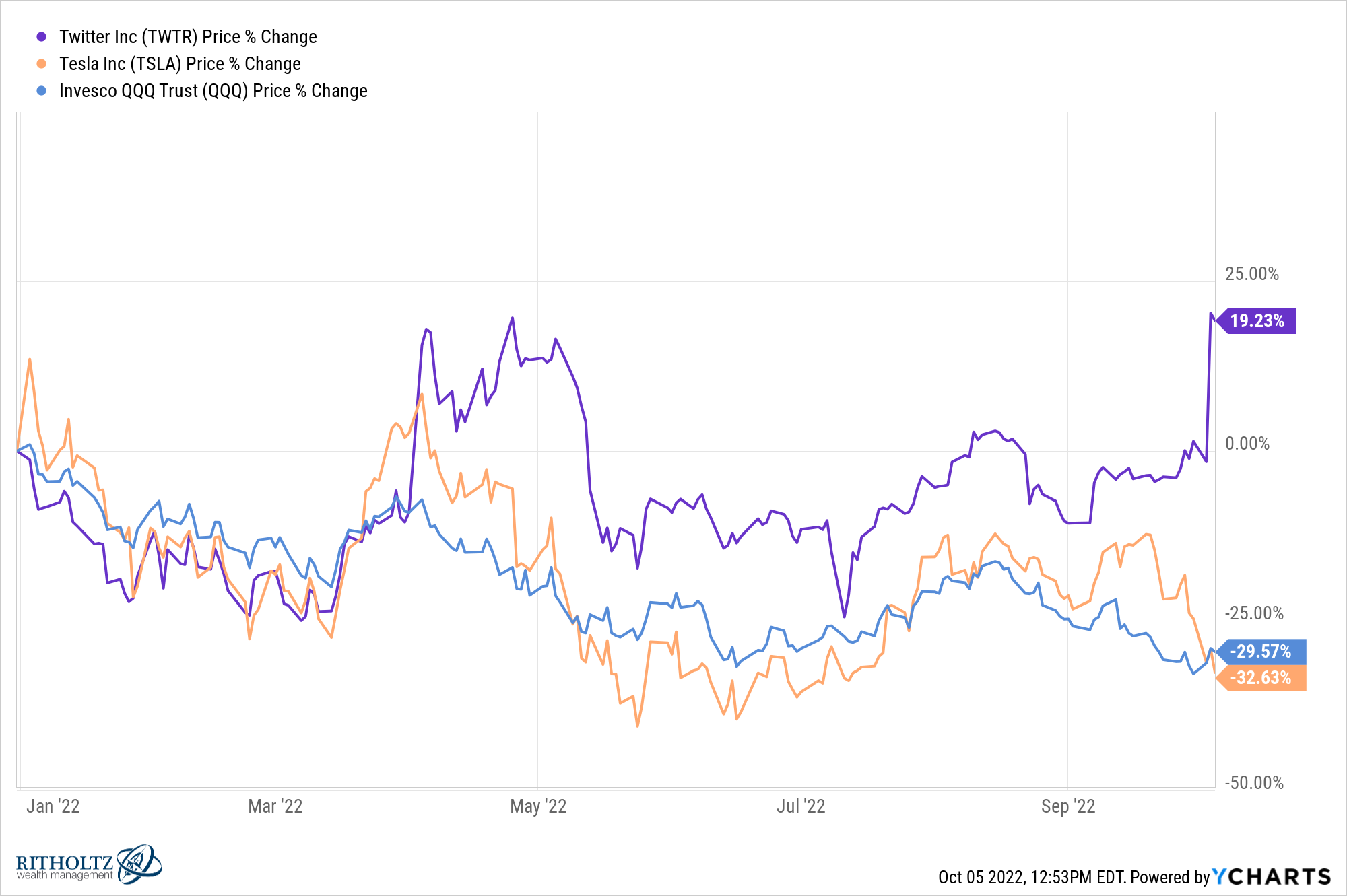

- Everything about the Twitter ($TWTR) deal has been about 'Elon being Elon.' (arstechnica.com)

- How much is Musk overpaying for Twitter ($TWTR)? (barrons.com)

- A Musk-owned Twitter ($TWTR) will be drama-filled. (nytimes.com)

- It's not over until Twitter ($TWTR) shareholders are paid. (bloomberg.com)

- What next for Twitter ($TWTR)? (howardlindzon.com)

Retail

- American retailers are once again opening locations on a net-basis. (wsj.com)

- Goodwill is planning to compete with other luxury resales sites. (bloomberg.com)

- REI is permanently done with Black Friday. (cnn.com)

Finance

- Markets are convinced Credit Suisse need to raise a lot of capital. (ft.com)

- Why you should be wary of companies that become unicorns way too fast. (news.crunchbase.com)

Economy

- Heavy truck sales are strong. (calculatedriskblog.com)

- How the strong U.S. dollar is affecting emerging economies. (nytimes.com)

Earlier on Abnormal Returns

- Personal finance links: failing retirement. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: expected future earnings. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)