Quote of the Day

"Reading old finance articles makes you feel like the ancient past was no different than today – the opposite feeling you get reading old medical commentary."

(Morgan Housel)

Chart of the Day

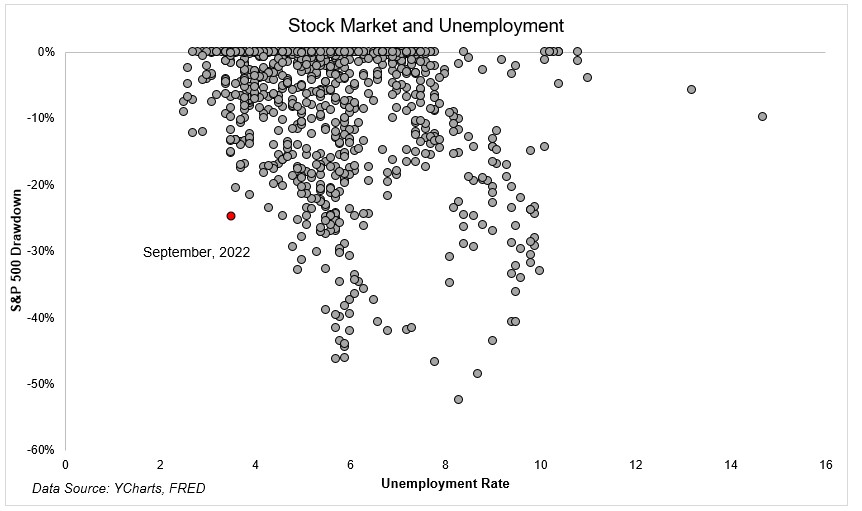

The S&P 500 has never experienced a decline this deep with unemployment below 4%.

Small caps

- Small caps are outperforming of late. (allstarcharts.com)

- And valuations are still attractive. (gmo.com)

Strategy

- The past two years help show the agony and ecstasy of stock picking. (awealthofcommonsense.com)

- Joachim Klement, "The people who are committed to sin stock investing are a small minority and are unlikely to shift the consensus away from the ESG investing trend." (klementoninvesting.substack.com)

Crypto

- Leah McGrath Goodman, "Crypto’s abject refusal to die has infuriated many, inspiring no shortage of blistering screeds." (institutionalinvestor.com)

- Are retail investors going to return to crypto? (wsj.com)

- People are removing .eth from their profiles. (theinformation.com)

Companies

- Five myths about Meta ($META) including 'users are fleeing Facebook.' (stratechery.com)

- The FTC is increasingly cracking down on customer data breaches. (nytimes.com)

Global

- Europe's energy crisis is far from over. (economist.com)

- With economic sanctions in place, it's back to the future for the Russian auto industry. (wsj.com)

- Poland is planning to build nuclear power plants. (fortune.com)

Economy

- Three things that are dampening economic pain, including remote work. (theirrelevantinvestor.com)

- Media mentions of recession do tick higher before a recession. (mrzepczynski.blogspot.com)

- How long will we stay in an era of the strengthening dollar? (econbrowser.com)

Earlier on Abnormal Returns

- Adviser links: the paradox of Social Security. (abnormalreturns.com)

- Why rough edges remain in financial markets: people. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- What everyone was reading last week on the site. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)