Quote of the Day

"One year ago, Jay Powell threw out the rulebook global investors had used for over a decade."

(Katie Martin and Harriet Agnew)

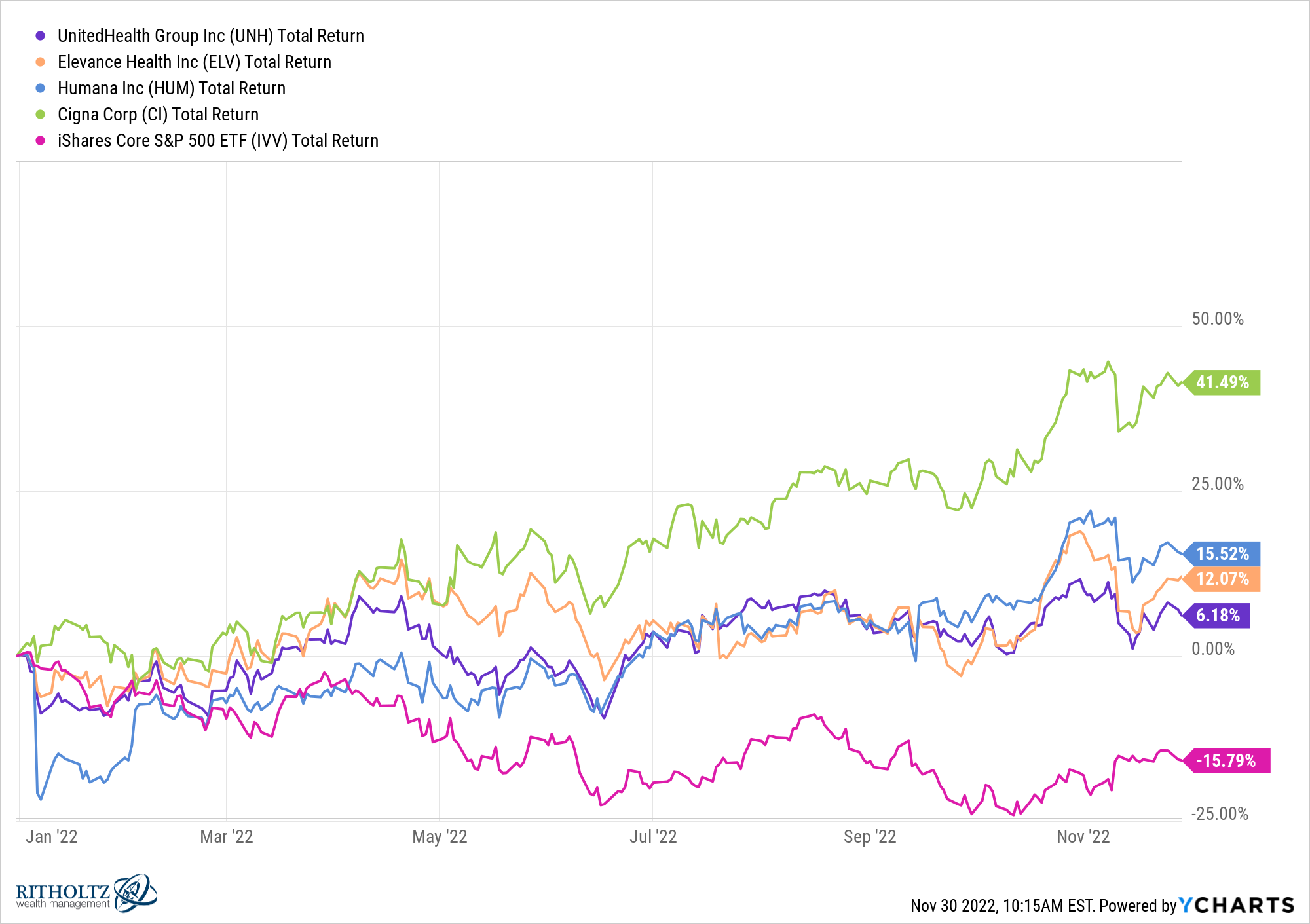

Chart of the Day

Managed care companies have been a good hiding place in 2022. (chart via @ycharts)

Strategy

- Good luck trying to forecast the market using geopolitical events. (awealthofcommonsense.com)

- On the death of the 60/40 portfolio. (peterlazaroff.com)

- Rising interest rates have completely changed the investment landscape. (on.ft.com)

- What is, and isn't, market timing. (obliviousinvestor.com)

Crypto

- More lenders are having to repossess Bitcoin mining rigs. (bloomberg.com)

- Kraken is laying off 20% of its work force. (blockworks.co)

Companies

- Airbnb ($ABNB) is now targeting the entire housing market. (drorpoleg.com)

- Some Chinese companies are trying to shed their association with their home country. (wsj.com)

Venture capital

- The venture reset is here. Investors with capital are going to see better opportunities. (howardlindzon.com)

- How much of a startup investor’s success can be attributed to luck? (news.crunchbase.com)

- Stop adding new features to your app. (debugger.medium.com)

- Blitzscaling as a strategy is done. (collabfund.com)

Funds

- The fees on Vanguard funds don't always go down. (riabiz.com)

- Why so many people are launching ETFs. (blog.etfthinktank.com)

Economy

- The October JOLTS report shows continued slowing. (bonddad.blogspot.com)

- Housing affordability is still at highly elevated levels. (calculatedrisk.substack.com)

Earlier on Abnormal Returns

- Personal finance links: what other people think. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: expensive protection. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)