Quote of the Day

"So no one knows what a mild recession is - no one really knows how long it will last or what will happen, but the it’s the base case for a lot of people."

(Kyla Scanlon)

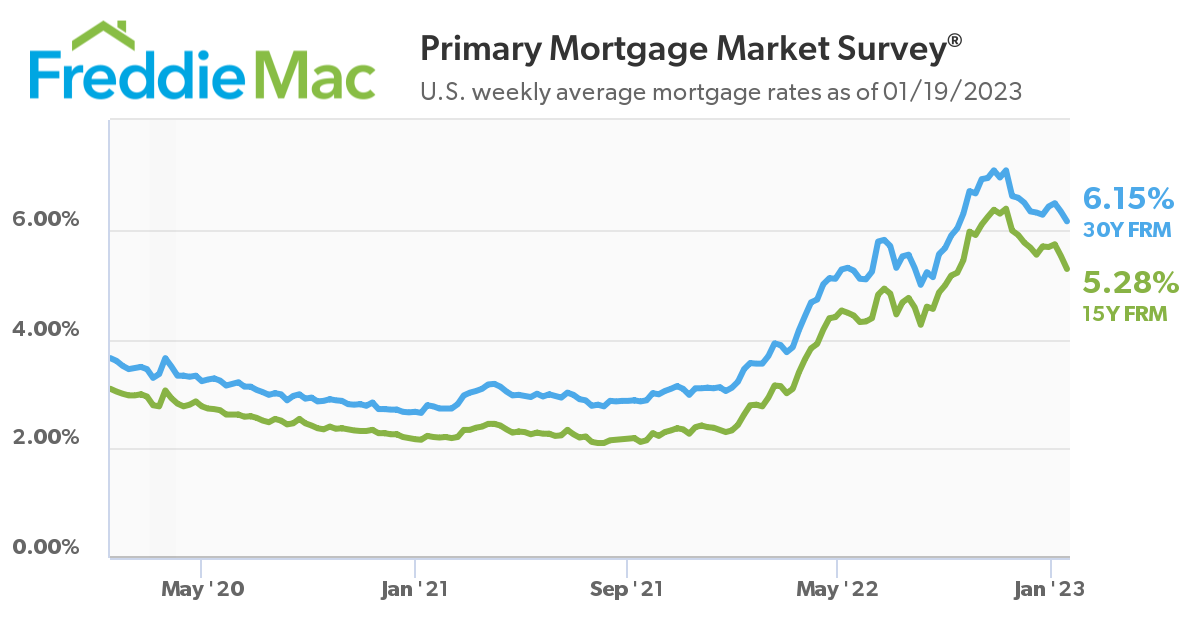

Chart of the Day

Mortgage rates are at four-month lows. (chart via Freddie Mac)

Markets

- Is this a new bull market? Hold on... (theirrelevantinvestor.com)

- When it comes to active management, hope springs eternal. (on.ft.com)

- Ashby Monk, “The Swensen model is the Swensen model because of leadership...That human being had the drive to take all of these inputs and drivers and build the Yale Model.” (institutionalinvestor.com)

Finance

- When will VCs deploy all their 'dry powder'? (economist.com)

- Middle East sovereign wealth funds have only grown in their impact. (bloomberg.com)

- If you are going to have office space, better make sure it's pretty nice. (economist.com)

Companies

- United Airlines ($UAL) earnings are 30% above where they were pre-pandemic. (wsj.com)

- Amazon ($AMZN) is shutting down Amazon Smile. (fastcompany.com)

- Plant-based meats now look like a transitional technology, i.e. a fad. (bloomberg.com)

Hedge funds

- Why higher interest rates are a good thing for hedge fund managers. (institutionalinvestor.com)

- Founders Fund was selling out of Bitcoin, while Peter Thiel was talking it up. (on.ft.com)

Global

- Why Chinese entrepreneurs are decamping to Singapore. (nytimes.com)

- We are living in the age of the grandparent. (economist.com)

Economy

- Weekly initial unemployment claims remain quiescent. (calculatedriskblog.com)

- A record number of houses are under construction in December. (bonddad.blogspot.com)

- Where homebuilders are cutting prices. (calculatedrisk.substack.com)

- Central banks need to add some nuance to their policies. (ritholtz.com)

Earlier on Abnormal Returns

- Longform links: shareholder primacy. (abnormalreturns.com)

- What you missed in our Wednesday linkfest. (abnormalreturns.com)

- Personal finance links: the endowment effect. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)