Quote of the Day

"Everything on the internet is dumb and shameful until it’s not."

(Ryan Broderick)

Chart of the Day

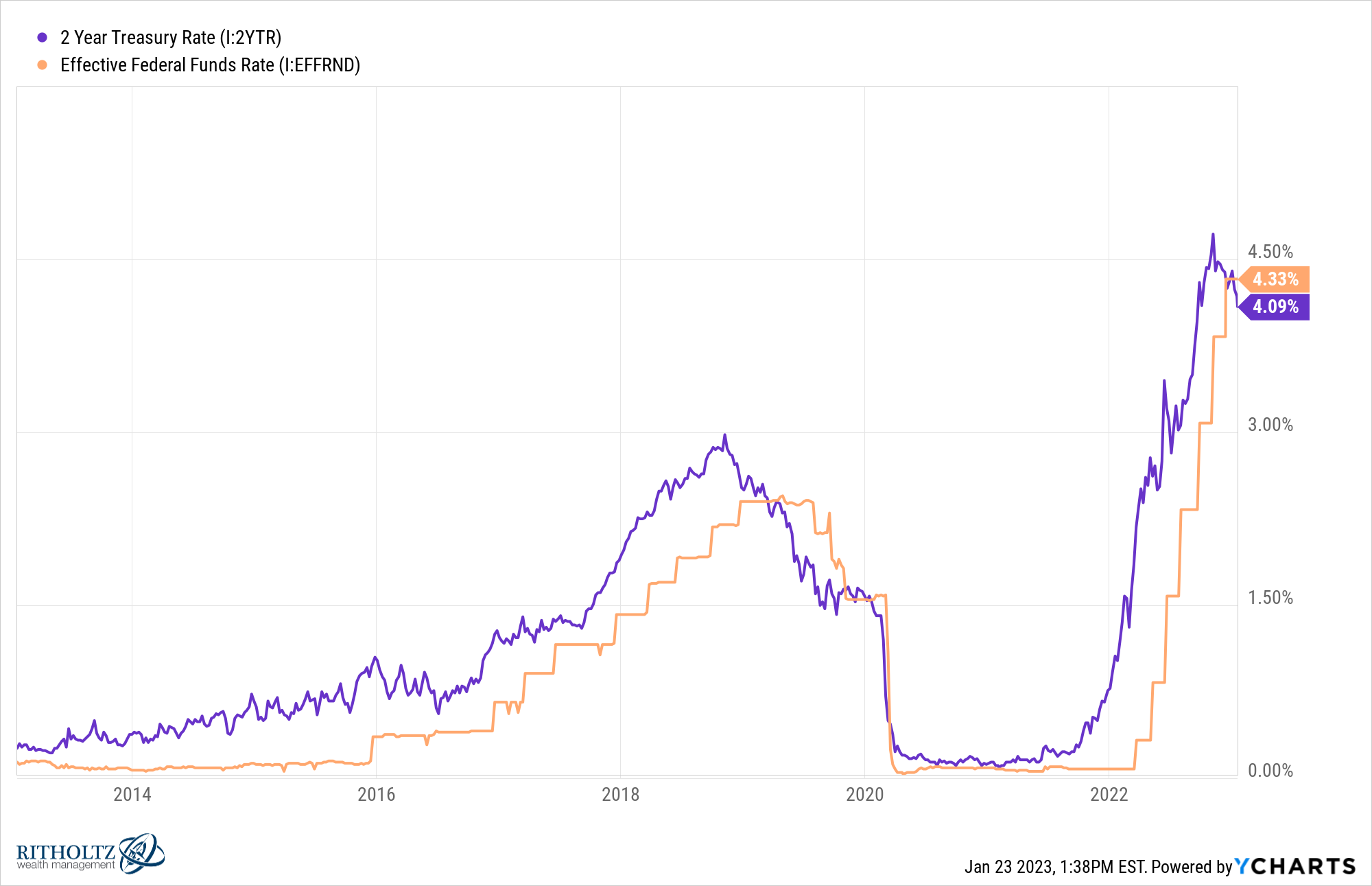

Ben Carlson, “If the labor market remains strong the Fed is the biggest risk to the economy this year.” (chart via @ycharts)

Retail trading

- Say Technologies is making it easier for companies and shareholders to interact. (axios.com)

- How zero-commissions affect investor behavior. (papers.ssrn.com)

Companies

- Netflix ($NFLX) really is on the cusp of a new era. (stratechery.com)

- Salesforce ($CRM) has attracted an activist investor in Elliott Management. (wsj.com)

- Spotify ($SPOT) is cutting its workforce. (techcrunch.com)

AI

- Microsoft's ($MSFT) big investment in OpenAI is a go. (axios.com)

- ChatGPT could earn a MBA. (ft.com)

- How AI can make programmers more productive. (avc.com)

- Five insights from "What Makes Us Human: An Artificial Intelligence Answers Life’s Biggest Questions" by Iain Thomas and Jasmine Wang. (nextbigideaclub.com)

- The biggest problem with ChatGPT is our gullibility. (seths.blog)

ETFs

- The ETF industry is a 30-year success story. (ft.com)

- ETFs help popularize the idea of index fund management. (wsj.com)

Funds

- Ken Griffin's Citadel hedge fund has become the biggest earner of all-time. (marketwatch.com)

- How money managers get paid depends on a lot of things. (capitalgains.thediff.co)

- Are the new non-traded REITs any better than prior versions? (investmentnews.com)

Earlier on Abnormal Returns

- Adviser links: the overarching idea. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- What everyone read last week on Abnormal Returns. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)