Quote of the Day

"The way to get new ideas is to notice anomalies: what seems strange, or missing, or broken?"

(Paul Graham)

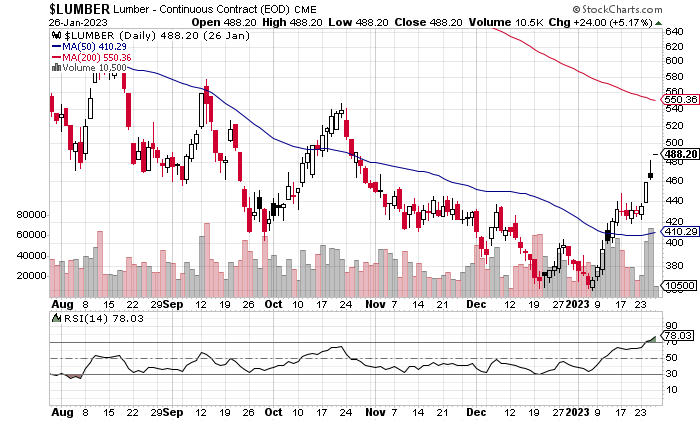

Chart of the Day

Lumber prices have stopped going down. (chart via StockCharts)

Strategy

- The investment landscape has completely transformed in the past century. (awealthofcommonsense.com)

- 2022 shows that every portfolio strategy comes under pressure. (portfoliocharts.com)

- Why so many investors get caught up in return chasing. (novelinvestor.com)

- The stock market is constantly providing us 'instant feedback' much to our detriment. (rationalwalk.com)

Funds

- Dividend-focused funds are having their moment. How do they perform over the long run? (morningstar.com)

- Taxable distributions in a down year is a double-whammy. (nytimes.com)

Companies

- Revisiting Tesla's ($TSLA) valuation, post-Twitter fiasco. (aswathdamodaran.blogspot.com)

- Some big spinoffs are coming down the pike including ones from J&J ($JNJ) and 3M ($MMM). (morningstar.com)

- CVS ($CVS) and Walmart ($WMT) are cutting back pharmacy hours. (wsj.com)

- Intel ($INTC) had a tough 2022 and 2023 isn't looking better. (cnbc.com)

- Zillow ($Z) has a new AI-powered way to search for homes. (thebasispoint.com)

Housing

- The Fed's policies are hitting the economy primarily through the housing channel. (econbrowser.com)

- Jerusalem Demsas, "If there are no solid data supporting the institutional-investor-scapegoat story, there are certainly plenty of misleading statistics." (msn.com)

- Homebuilders have an oversupply of unsold new homes. (housingwire.com)

- Consumers are slowly coming to terms with higher mortgage rates. (axios.com)

Earlier on Abnormal Returns

- Podcast links: the simulation of learning. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: shrinking populations. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)