Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at the difference between arithmetic and geometric returns.

Quote of the Day

“If there is reason to believe that companies are vulnerable to climate risk or the impact of some other E.S.G. factor, fiduciaries are obligated to consider those factors.”

(Cynthia Hanawalt)

Chart of the Day

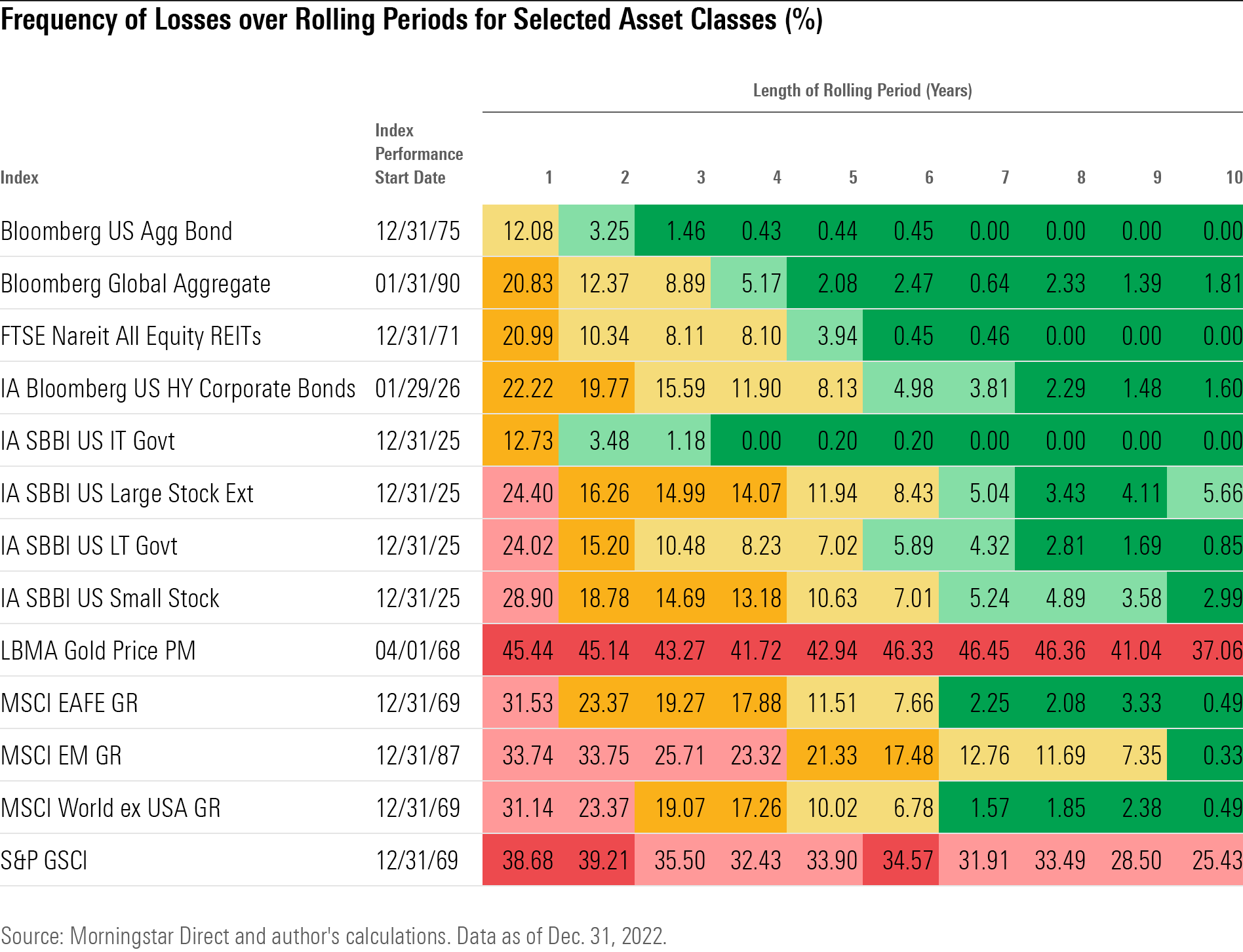

How long it has taken for various asset classes to recover losses, historically.

Indexing

- The index effect is disappearing. (papers.ssrn.com)

- Does additional scrutiny, via index inclusion, hurt a company's performance. (papers.ssrn.com)

Fund management

- How do active managers invest their own money? (ritholtz.com)

- Fund investors reward fund managers with 'skin in the game.' (papers.ssrn.com)

Research

- The time period over which you measure correlations matter. (insights.finominal.com)

- How three tail-hedging strategies have performed during recent downturns. (wealthmanagement.com)

- Another example of 'rebalance timing luck.' (papers.ssrn.com)

- The drivers of equal-weight portfolio performance are straightforward. (klementoninvesting.substack.com)

- How ChatGPT, and other LLMs, will change how investors do their work. (blog.validea.com)

- How anti-ESG movements could be contrary to a fiduciary duty. (nytimes.com)