Quote of the Day

"Investing isn’t a purity test. You’re allowed to take some chances and have some fun. But do so within reason."

(Don Phillips)

Chart of the Day

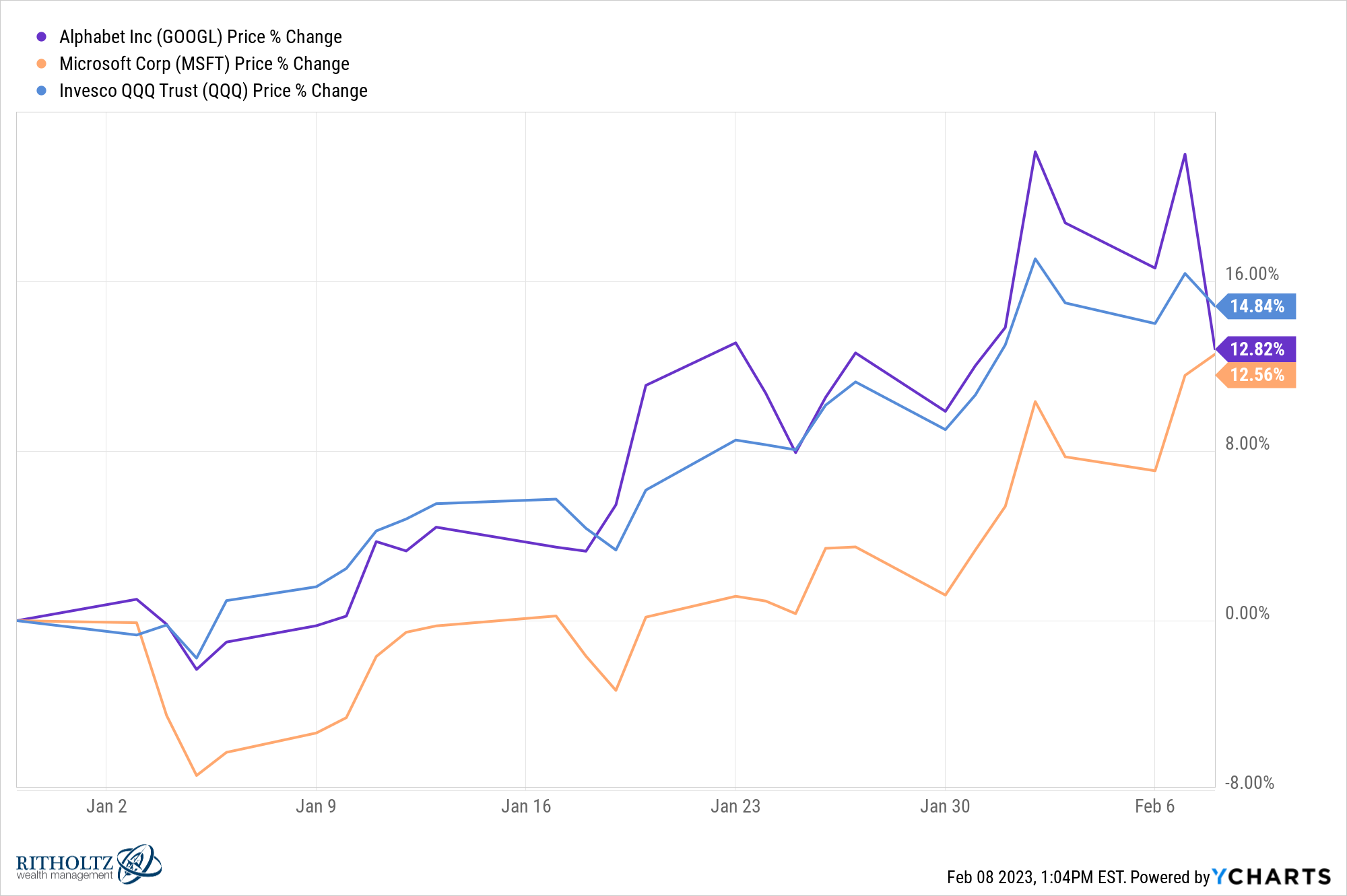

Investors were underwhelmed with Google’s AI presentation. (chart via @ycharts)

Markets

- Ben Carlson, "Don’t buy or sell or hold anything because someone on TV or YouTube or Twitter or a blog or a TikTok video tells you to." (awealthofcommonsense.com)

- Neil Dutta, "In my view, what makes someone worth listening to is whether their thought process makes sense. It is not enough to point to this indicator or that one." (businessinsider.com)

AI

- AI-powered search could help kill off the link ecosystem. (niemanlab.org)

- A first-hand account of using the new AI-powered Bing. (wsj.com)

Finance

- Fees at successful multi-strategy hedge funds are only going up. (ft.com)

- Why Rothschild & Co. wants to ditch outside shareholders. (ft.com)

Apple

- Apple ($AAPL) wants to expand the reach of its advertising efforts. (wsj.com)

- Where Apple ($AAPL) is falling down on the job. (sixcolors.com)

- Four big macro risks for Apple ($AAPL). (macworld.com)

Economy

- James Surowiecki, "Fed chairs don’t just have to be good at making policy. They now also have to be good at communicating. And they have to do that without any real rule book." (msn.com)

- CEOs are at-risk of getting caught flat-footed if the economy re-accelerates. (bloomberg.com)

- Getting laid off in a hot jobs market is not the worst thing in the world. (msn.com)

- Credit conditions were tightening in Q4. (bonddad.blogspot.com)

- Q1 GDP forecasts are all over the place. (econbrowser.com)

Earlier on Abnormal Returns

- Personal finance links: temporary setbacks. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: hardwiring good behavior. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)