Quote of the Day

"Once risk and luck are brought into play, it is easy to see how two people of equal skill and intelligence can end up with very different outcomes."

(Tyler Cowen)

Chart of the Day

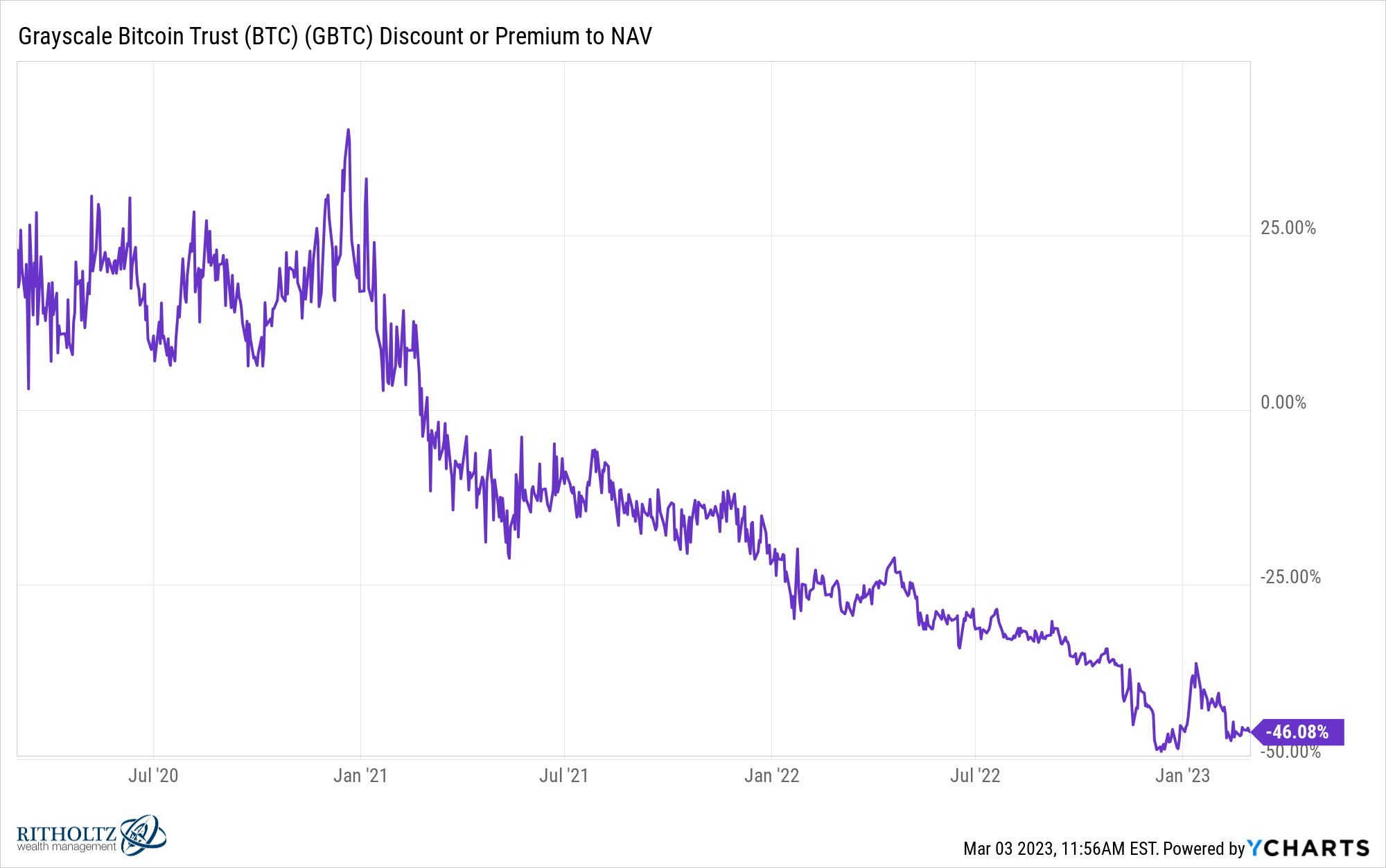

The Grayscale Bitcoin Trust ($GBTC) trades at a ~46% discount to NAV a week before its SEC case goes to trial. (via @ycharts)

Markets

- Retail investors can't quit Tesla ($TSLA) stock. (wsj.com)

- Softbank is planning to IPO chip maker Arm Holdings in New York. (cnbc.com)

- Short-dated options are distorting market data. (ft.com)

Strategy

- When does it make sense to take on duration in your bond portfolio? (awealthofcommonsense.com)

- Index funds have two major advantages. (morningstar.com)

Berkshire Hathaway

- Evidence that Warren Buffett has become less verbose over time. (aaii.com)

- Some lessons from the 2022 Berkshire Hathaway ($BRK.A) shareholder letter. (novelinvestor.com)

Housing

- 30-year mortgage rates are once again over 7.0%. (cnbc.com)

- First time home buyers are facing record unaffordability. (bloomberg.com)

- The median U.S. home-sale price declined 0.6% year over year in February. (redfin.com)

- Mortgage providers, like Rocket ($RKT), are cutting back. (housingwire.com)

Work

- Layoffs have lasting implications. (axios.com)

- American workers are not returning to the office like they are overseas. (cnbc.com)

- There's no established playbook for hybrid work. (nyti.ms)

- Why everyone should learn to play poker. (axios.com)

Earlier on Abnormal Returns

- Podcast links: a growing crisis. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: the mental health crisis. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)