Quote of the Day

"The Takeconomy unfortunately awards those that scream fire in the crowded theater."

(Kyla Scanlon)

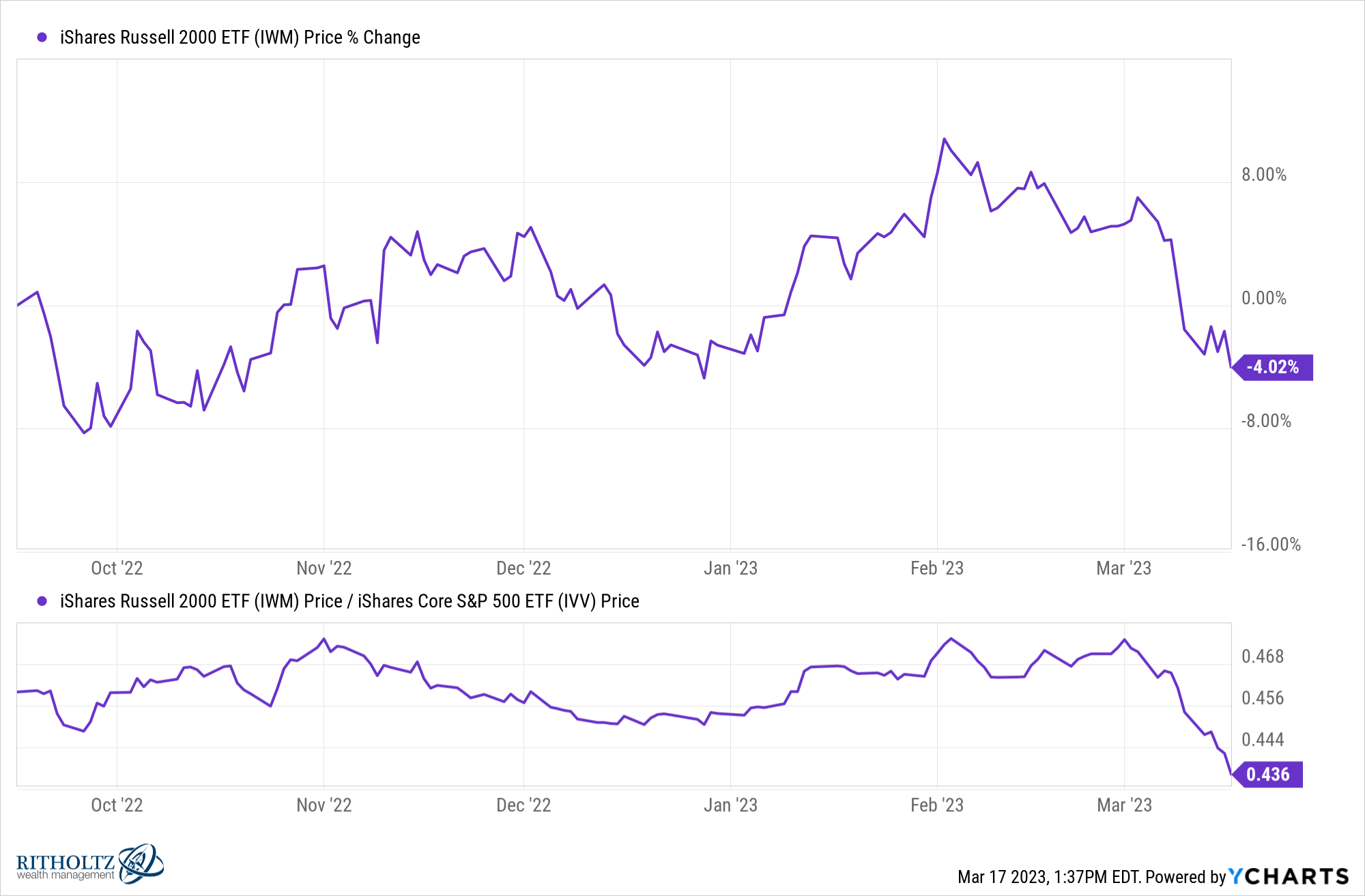

Chart of the Day

Small caps don’t like bank crises. (@CameronDawson with chart via @ycharts)

Finance

- Why First Republic Bank ($FRC) isn't bouncing. (thebasispoint.com)

- WeWork ($WE) has reached a deal with Softbank to restructure its debt. (nytimes.com)

- Fidelity Crypto is now live. (theblock.co)

SVB

- SVB didn't go bust because it was woke. (theverge.com)

- But poorly managed remote work maybe did. (axios.com)

- How the downfall of SVB could affect climate and biotech startups. (nature.com)

- Why many people want SVB to survive in some form or fashion. (semafor.com)

- Money moves so quickly making it hard to combat a bank run. (mrzepczynski.blogspot.com)

- The Fed is a bad bank regulator. (mattstoller.substack.com)

Fund management

- Tiger Global wrote down the value of its venture portfolio by 33% in 2022. (wsj.com)

- Despite diversification efforts, private credit still drives Ares Management ($ARES). (institutionalinvestor.com)

Economy

- Has the banking crisis increased the odds of a recession? (axios.com)

- Industrial production was flat in February 2023. (calculatedriskblog.com)

- It's hard to run a semiconductor manufacturing plant without trained workers. (wsj.com)

Earlier on Abnormal Returns

- Podcast links: third places. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: combating burnout. (abnormalreturns.com)

- Don’t waste your emotional capital investing out of spite. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)