Quote of the Day

"The system can be saved AND those responsible for crashing it be made to suffer the consequences of their follies."

(Barry Ritholtz)

Chart of the Day

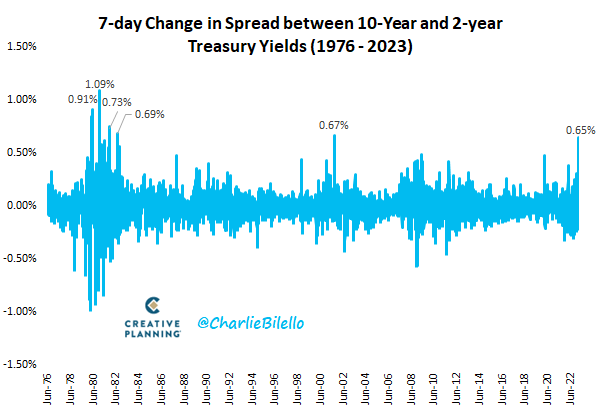

The 2-10s yield curve saw a huge reversal in the past week. (via @charliebilello)

Markets

- Treasury market liquidity is not great. (bloomberg.com)

- Rising rates are still working their way through the markets and economy. (allisonschrager.substack.com)

Crypto

- Bitcoin has been on a tear YTD. (allstarcharts.com)

- New York Community Bank is acquiring Signature Bank but not its crypto assets. (blockworks.co)

- The remaining crypto firms are undergoing a rebrand. (nytimes.com)

Big Tech

- Amazon ($AMZN) is laying off another 9,000 workers. (cnbc.com)

- When will weakness in the tech sector spill over into the broader economy? (wsj.com)

- Is generative AI the next big tech platform? (axios.com)

Finance

- AT1 investors are feeling the pain of the demise of Credit Suisse. (ft.com)

- Job number one in a financial crisis is to stop the contagion. (theatlantic.com)

- Regional banks still have a big problem: skittish depositors. (ft.com)

- Silicon Valley Bank was a big lender to California vineyards. (vinepair.com)

CFA

- The CFA Institute is overhauling its testing. (institutionalinvestor.com)

- ChatGPT-4 was unable to pass the old CFA level 3 exam. (ft.com)

Earlier on Abnormal Returns

- Adviser links: ventilation of your schedule. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Top clicks last week on the site. (abnormalreturns.com)

- Why seemingly impossible things happen all the time. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)