Wednesdays are all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at why retirement planning is a moving target.

Quote of the Day

"A TIPS is risky in the short term and riskless in the long run, which is precisely the opposite of, and complementary to, a T-bill, which is riskless in the short term but, because of reinvestment rate volatility, risky in the long run."

(William Bernstein)

Chart of the Day

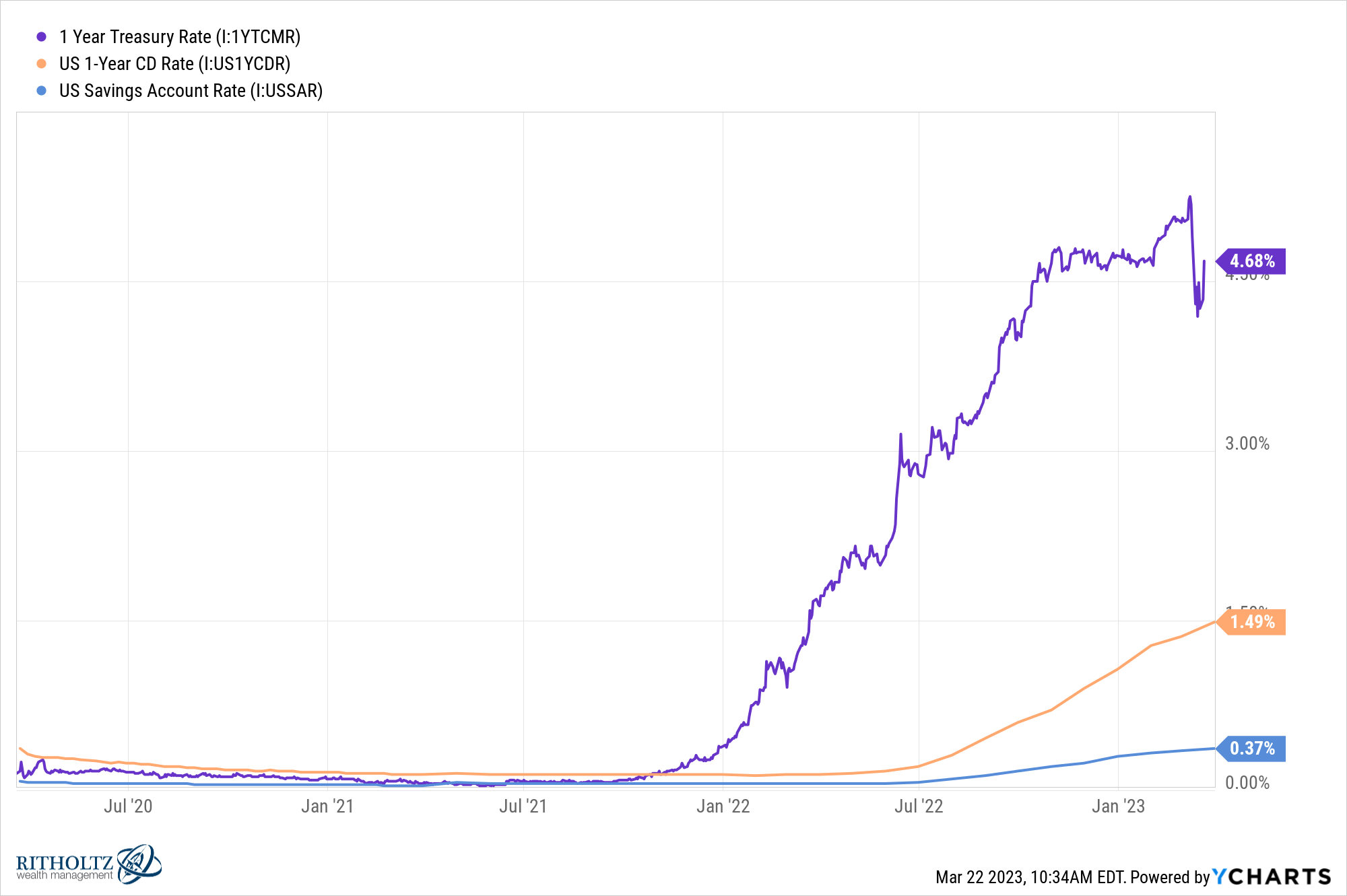

How to think about your cash in the new era of banking. (chart via @ycharts)

Podcasts

- Morgan Housel talks about his top 30 rules of the money game. (open.spotify.com)

- Jeff Ptak and Christine Benz talk financial independence with Brad Barrett, co-founder of ChooseFI. (morningstar.com)

Retirement

- Retirement is filled with all sorts of challenging decisions. (humbledollar.com)

- Stranded retirement accounts are a big problem. (nytimes.com)

- What goes into the decision about taking a lump sum pension payout. (humbledollar.com)

Financial planning

- Financial plans need to be turned into concrete action items. (thomaskopelman.com)

- Good financial planning makes divorce less painful. (evidenceinvestor.com)

Cars

- Car buying is not yet back to normal. (humbledollar.com)

- Doug Boneparth talks with @GuyDealership on why it will take awhile for the car market to normalize. (thisisthetop.substack.com)

Happiness

- Your purpose in life isn't to make money. (moretothat.com)

- Spend money on stuff that really moves the needle. (dariusforoux.com)

- Who exactly wanted you to believe that money doesn't buy happiness? (theguardian.com)

- A little bit of status seeking goes a long way. (radreads.co)

Personal finance

- Having more money doesn't make you better at managing it. (awealthofcommonsense.com)

- Why we need different types of relationships with our money and with people. (onmoneyandmeaning.substack.com)

- Lessons learned from building a new home in a pandemic. (ramp.beehiiv.com)

- The mainstream (and social) media are not your friends. (tonyisola.com)