Quote of the Day

"Squelching inflation is the Fed’s goal, and a credit crunch set off by bank failures could get it there quickly."

(Jeff Sommer)

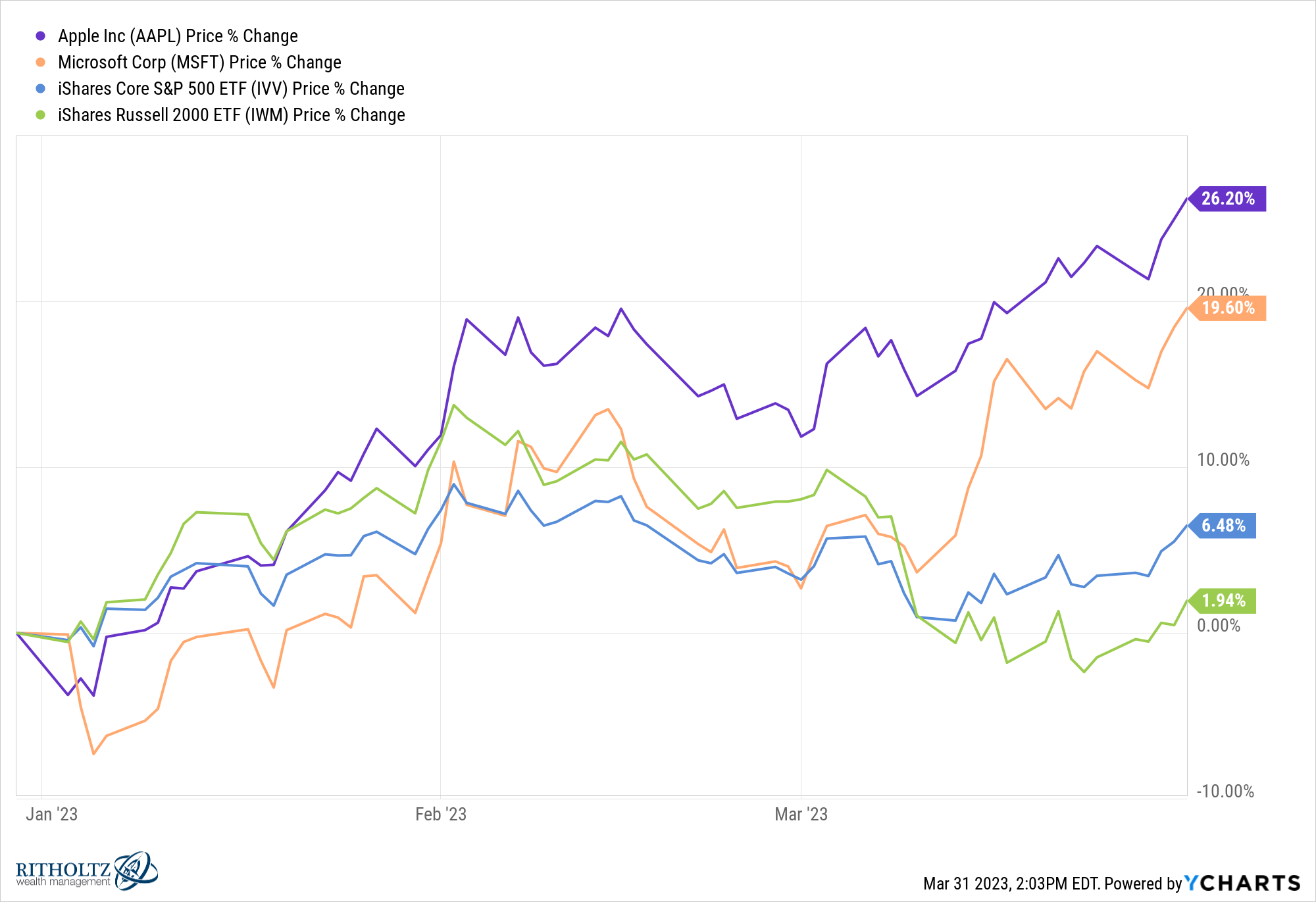

Chart of the Day

The biggest of Big Tech has been leading the market in Q1 2023. (chart via @ycharts)

Markets

- The stock market is on track for a good quarter. (allstarcharts.com)

- Money market mutual funds have seen a surge of inflows. (ft.com)

Books

- On the benefits of reading older books. (collabfund.com)

- Lessons learned from "The Panic of 1907" by Robert J. Bruner and Sean D. Carr. (novelinvestor.com)

Finance

- Times are tough these days for investment bankers. (ft.com)

- Do junior hedge fund analysts need additional training? (institutionalinvestor.com)

- Where the first graduate's of Yale's asset management program landed. (institutionalinvestor.com)

AI

- We really have no idea what ideas AI is going spawn. (drorpoleg.com)

- Tomasz Tunguz, "In generative AI, innovation & distribution are inextricably linked, feeding each other." (tomtunguz.com)

Economy

- The February PCE came in at 5.0% down from a 2022 high of 7.0%. (calculatedriskblog.com)

- Real personal income is decelerating. (bonddad.blogspot.com)

- GDP forecasts are tracking around 2%. (econbrowser.com)

- People were really freaking out about inflation a year ago. (thebasispoint.com)

Earlier on Abnormal Returns

- Podcast links: choking under pressure. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Longform links: the age of average. (abnormalreturns.com)

- Do you wonder why everything looks the same these days? (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)