Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at the case for equal-weighted portfolios.

Quote of the Day

"When it comes to expert talk in the [financial] media, engagement with the truth does not appear to be natural, easy, or automatically expected by the parties involved."

(Alex Preda)

Chart of the Day

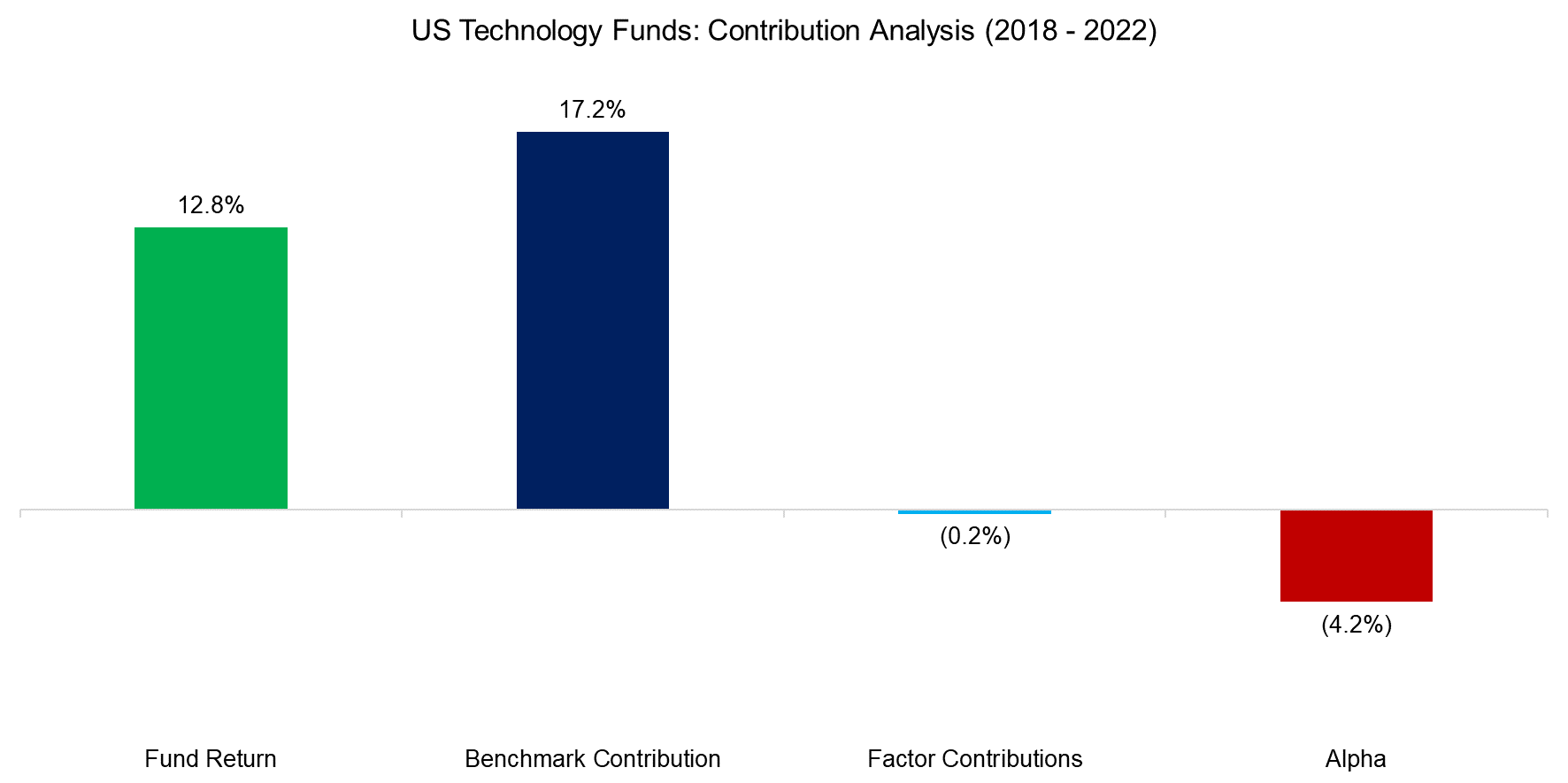

Even tech investors have a hard time outperforming a passive index.

AI

- The Bloomberg terminal just got a ChatGPT type interface. (institutionalinvestor.com)

- A round-up of research on the use of AI in finance (capitalspectator.com)

Factors

- There is a difference between long-short and long-only factor investing. (blog.validea.com)

- Momentum and reversal should be treated as separate effects. (alphaarchitect.com)

- How to use coskew to improve momentum returns. (mrzepczynski.blogspot.com)

- Why the profitability factor should be adjusted for intangibles. (papers.ssrn.com)

Retail

- On the (poor) returns to retail investors for complex options strategies. (papers.ssrn.com)

- The collapse of FTX had little impact on traditional financial markets. (alphaarchitect.com)

Research

- Has indexing changed the informational efficiency of stock prices? (alphaarchitect.com)

- Do ESG ratings need to be regulated? (ft.com)

- Dimensionality and the problem of backtesting. (priceactionlab.com)

- What do economists misunderstand about business? (economist.com)

- How social skills affect analyst performance. (papers.ssrn.com)

- How earnings surprises affect job seekers. (papers.ssrn.com)