Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at why equities are an imperfect inflation hedge.

Quote of the Day

"Size doesn’t matter when it comes to value investing. Valuation does."

(Wes Gray)

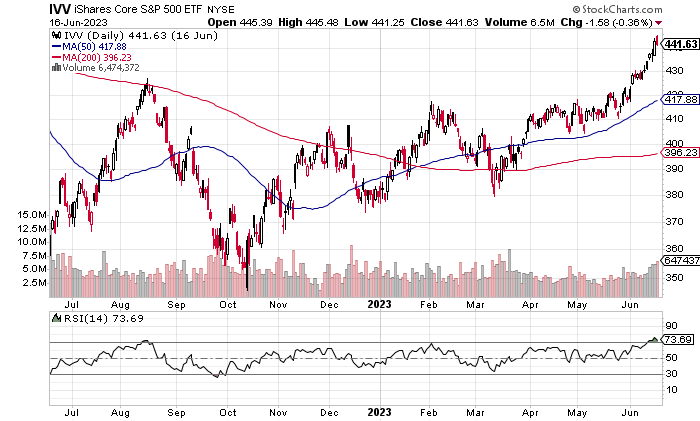

Chart of the Day

What historically happens after the stock market becomes overbought, as measured by the RSI. (chart via @StockCharts)

Backtests

- Why backtests go wrong in the real world. (mrzepczynski.blogspot.com)

- Behold the worst backtest ever. (philbak.substack.com)

Factors

- Wes Gray, "Bottom line: if you are investing in long-only factor portfolios, focus on research that studies long-only factor portfolios, not long-short factors." (alphaarchitect.com)

- Factor models are not the future of active investing. (institutionalinvestor.com)

- Mark Rzepczynski, "Looking at hedge funds as either an option program or a linear combination of factors is a good start to describe the risks when investing with these alternatives." (mrzepczynski.blogspot.com)

Research

- Investors can't help themselves to fixate on short-term performance. (investmenttalk.co)

- Just how good are institutional investors? (papers.ssrn.com)

- How to reduce the costs of index replication. (alphaarchitect.com)

- Why cash isn't necessarily the safe asset. (cambriainvestments.com)

- Time horizon matters when it comes to training ML models. (papers.ssrn.com)

- VC valuations are highly associated with funding levels. (whoisnnamdi.substack.com)