Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at whether investors overpay for municipal bonds.

Quote of the Day

"The real reason PE firms want control of the companies they buy is not because of superior strategic insight but because they want to significantly leverage them."

(Dan Rasmussen)

Chart of the Day

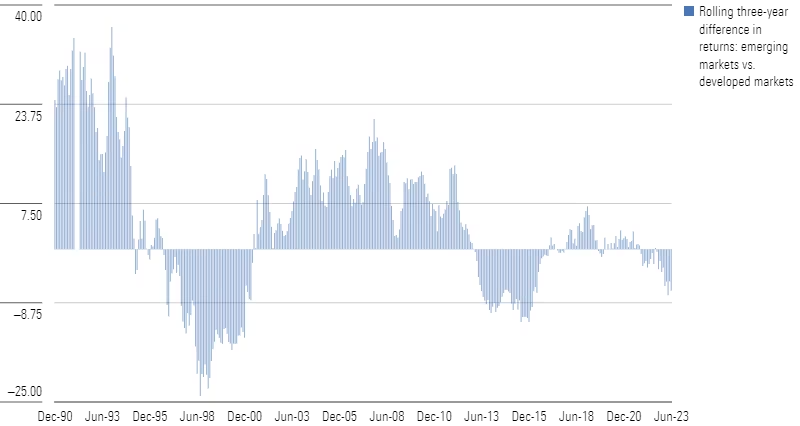

There’s nothing magical about emerging markets role in a portfolio.

Global

- The case for international diversification still stands, recency bias aside. (kitces.com)

- There's no reason to gorge on emerging market equities. (morningstar.com)

Overnight anomaly

- Trading the overnight effect is harder than it looks. (twoquants.substack.com)

- Why the overnight anomaly is hard to exploit. (ft.com)

Research

- Does size matter? Meh... (citywire.com)

- Why exactly is index concentration bad? (ft.com)

- John Rekenthaler, "Multistrategy funds have failed balanced-fund investors." (morningstar.com)

- Transaction costs matter, especially across strategies. (mrzepczynski.blogspot.com)

- Remember Warren Buffett's big put sales? How they turned out in practice. (ft.com)

- Do PE firms actually improve company performance? (mailchi.mp)

- How having a female CEO affects workplace compensation. (alphaarchitect.com)