Quote of the Day

"The mismatch between office supply and demand will likely continue for a long while. But no, remote work isn't dead. It's just getting started, and its impact on the shape of our cities and suburbs is only beginning to unfold."

(Dror Poleg)

Chart of the Day

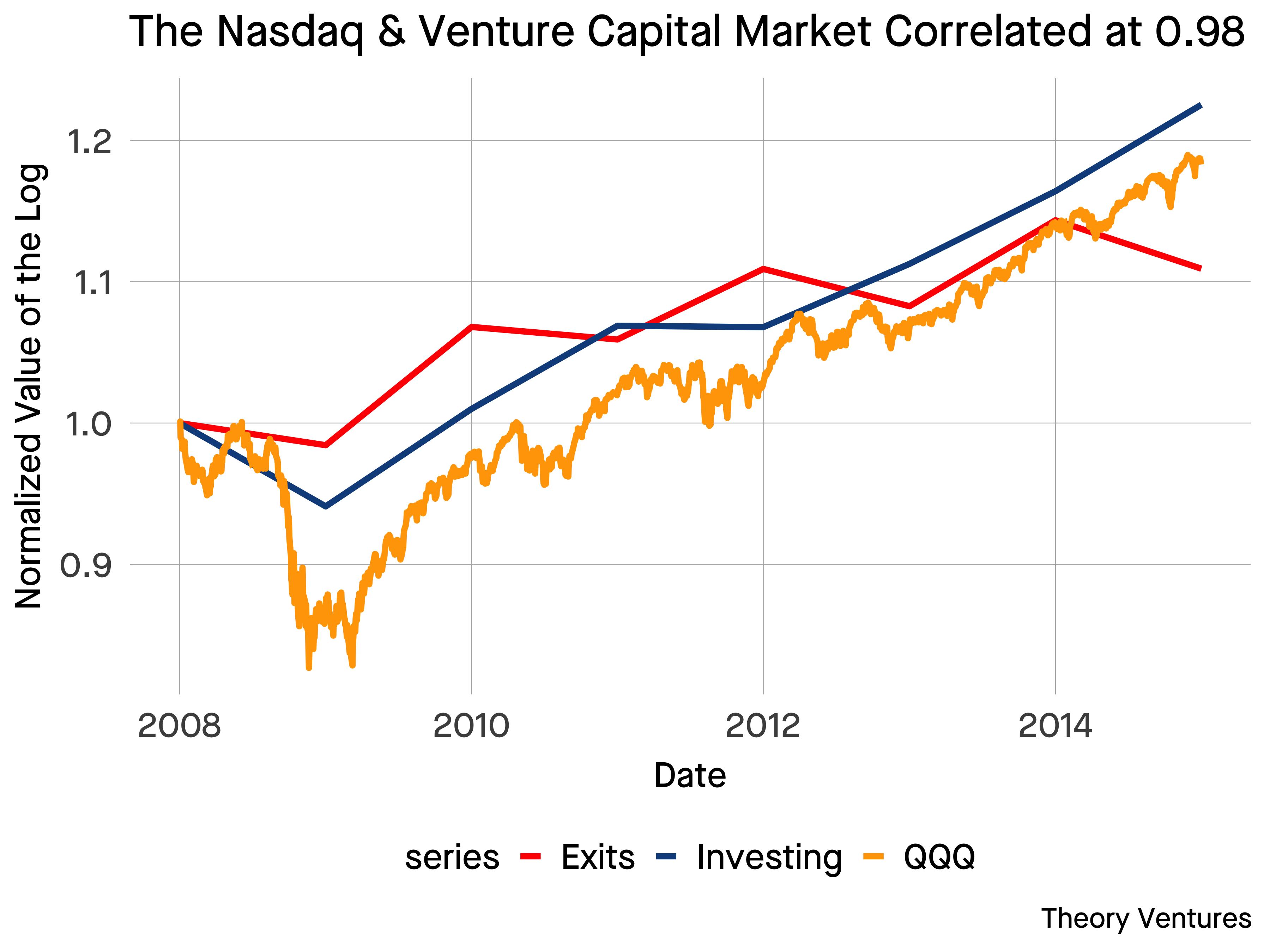

Strength in the Nasdaq 100 should eventually bleed into venture capital exits.

Crypto

- PayPal ($PYPL) has launched its own stablecoin. (theverge.com)

- Five questions about the PayPal stablecoin. (coindesk.com)

Companies

- How Apple ($AAPL) saves money on new chips manufactured by Taiwan Semi ($TSM). (theinformation.com)

- Uber ($UBER) seems to have threaded the needle. (youngmoney.co)

- A closer look at Berkshire Hathaway's ($BRK.A) second quarter results. (rationalwalk.com)

ETFs

- ETF fee compression is slowing. (insight.factset.com)

- The Bank of Japan owns some $260 billion in equity ETFs. (ft.com)

- ESG investing is shifting toward indexing not activism. (klementoninvesting.substack.com)

CRE

- Mike Bloomberg says get back to the office. (wapo.st)

- Worried about office buildings? Maybe you should be worried about apartment buildings. (wsj.com)

- Suburban office buildings have their own unique issues. (washingtonpost.com)

- American can't get enough self-storage. (wsj.com)

Economy

- Tyler Cowen, "It’s important to resist the temptation to think of economic expansions in moral terms." (advisorperspectives.com)

- Signs of weakness in temp work. (bonddad.blogspot.com)

- America's chip factories are going to need (trained) workers. (economist.com)

Earlier on Abnormal Returns

- Adviser links: next generation investors. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- What everyone else was reading on the site last week. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)