Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s edition including a look at an introduction to private credit.

Quote of the Day

"For most portfolios, beta will drive the majority of returns over the long run. As such, it will be far more fruitful to first exhaust sources of beta before searching for novel sources of alpha."

(Corey Hoffstein)

Chart of the Day

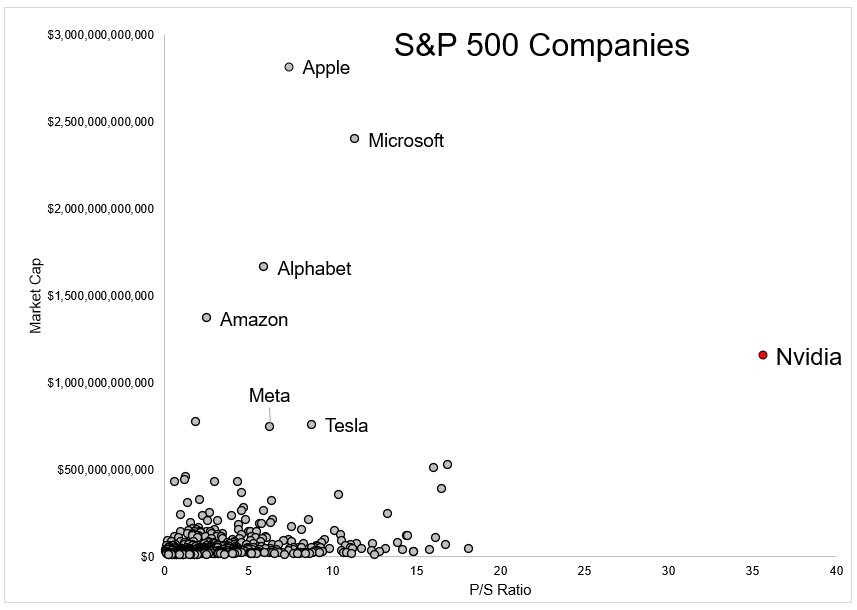

Nvidia ($NVDA) is one of the most expensive stocks in the S&P 500.

Research

- 15 lessons learned from the quantitative investment research business. (blog.thinknewfound.com)

- Should market valuations revert over time? Not necessarily. (thediff.co)

- Is illiquidity a feature or a bug? (savantwealth.com)

- How the 52-week high affects stock prices. (papers.ssrn.com)

- Historical returns are not set in stone. There are likely errors. (papers.ssrn.com)

- The research on structured notes shows pretty poor results. (alphaarchitect.com)

- Check out this S&P 500 historical return calculator. (ofdollarsanddata.com)

- Why forecasting housing prices is so challenging. (insights.finominal.com)

- How seasonal allergies increase the incidence of accidents. (nber.org)