Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s edition including a look at changes of the stock-bond correlation.

Quote of the Day

"The question isn’t whether you’re going to have losers, but rather how many and how bad relative to your winners."

(Howard Marks)

Chart of the Day

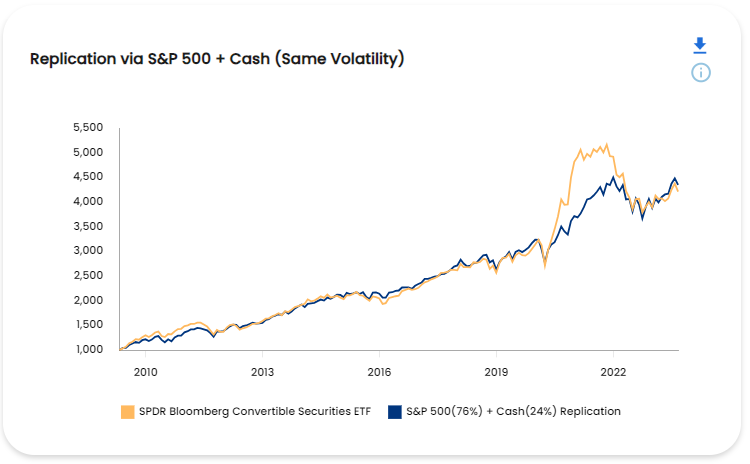

Convertible bond returns are well-explained by existing asset classes.

Trend following

- Trend following ignore narratives. (mrzepczynski.blogspot.com)

- How trend following can help diversify a portfolio. (priceactionlab.com)

ESG

- Green investing strategies should be lower risk. (alphaarchitect.com)

- ESG leaders have been outperforming the market. (bloomberg.com)

Behavior

- How scarcity affects decision making. (sciencedaily.com)

- The marshmallow effect and investment performance. (klementoninvesting.substack.com)

Research

- What is the relationship between the slope of the yield curve and the stock market? (mrzepczynski.blogspot.com)

- There's nothing magical about convertible bonds. (insights.finominal.com)

- Why you need different factors for bank stocks. (mailchi.mp)

- How cryptocurrency pump-and-dump schemes work in practice. (alphaarchitect.com)

- Does finance have a replication (or p-hacking) problem? (ft.com)